MORTGAGE RATES, TARIFF NEWS, AND VOLATILITY WHEN IS IT A GOOD TIME TO REFINANCE?

Vantage Winter 2020 Newsletter

Introducing Our New VMG Headquarters!

We are thrilled to introduce the new Vantage Mortgage Group headquarters! We’ve moved right down the road from our last location in Lake Oswego, Oregon where we’ve operated for over a decade. This expansion will allow us to continue to innovate and educate more consumers on how to secure a better mortgage through education, competition, and transparency.

We are so very thankful to ALL of our great clients and business partners for supporting us as the leading Mortgage Brokerage in Oregon (serving the entire Pacific NW) over the past 12 years. We could not do this without each and every one of you and you are greatly appreciated! Thank you so much for your ongoing referrals.

17040 Pilkington Rd. Ste. 300 Lake Oswego, OR 97035

Please look out for our Open House notices coming in March (or come visit us anytime)…

https://vantagemortgagegroup.com/weve-moved/

Rates at 3 1/2 year lows! Is it Time to Refinance?

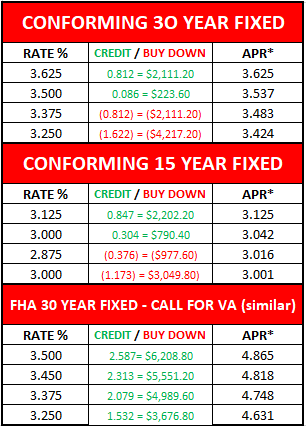

Rates have fallen to low levels this week that we have not seen since mid-2016 (from our own analytical tracking and not the National averages). The only lower time before the 2016 lows was in 2012. While no one can predict where rates will go (all market ‘experts’ are right about 50% of the time on their predictions)… when we see favorable historic pricing that reflects a benefit we suggest- “If you like it, lock it” conservatively.

Contact us for a custom rate quote anytime (always free and never obligated) or you can play with our pricing engine to run some general numbers.

**As a reminder, don’t fall for any mail solicitations/calls you receive from lenders, including your current loan servicer. Going back to the lender that services your loan results in higher rates and fees (and does not streamline as they do not own your loan and only service it). When competition doesn’t apply, costs are always higher with ‘one’ lender. This is why our wholesale lending partners are prohibited from soliciting our clients even if they service your loan so please report it to us if that happens and happy to compare quotes and details either way.

*Rates change daily. Conforming conventional interest rate samples based off $375,000 purchase price, $300,000 loan amount, 80% Loan to Value, 740 or higher FICO score, with impounds on a 30 day rate lock period and $995 underwriting fee if not covered by lender rebates. FHA based off $375,000 purchase price, 3.5% down payment, but other same variables. VA based off $375,000 purchase price, 100% financing, and 2.15% assumed funding fee. Costs or credits shown pertain to interest rate and do not include any other applicable 3rd party title and escrow charges or prepaid tax and insurance reserves which may or may not apply. Lock period suggested depends on current loan volume and lending climate at time of loan application and approval. Other risk-based pricing adjustment may apply. The displayed annual percentage rates (APRs) include total points and additional prepaid finance charges but do not include other closing costs. On adjustable-rate loans, rates are subject to increase over the life of the loan. Learn more about assumptions and APR Information. Loan pricing may only be locked through a home loan consultant to be effective. Rates will depend in part on your unique credit history and transaction characteristics. Please email or call for updated pricing at anytime as rates and pricing are subject to change. This information does not constitute a loan commitment or approval.

Vantage Named Top Mortgage Employer

We are very thankful for Vantage Mortgage Group, Inc. to be recognized for a 4th time as one of America’s Top Mortgage Employers in 2020! We take pride in our ability to offer our employees access to investors, pricing, compensation, and benefits few others can. We love our team and our culture. As a top local independent Mortgage Brokerage in the Pacific NW – we thank @National Mortgage Professional Magazine for this recognition.

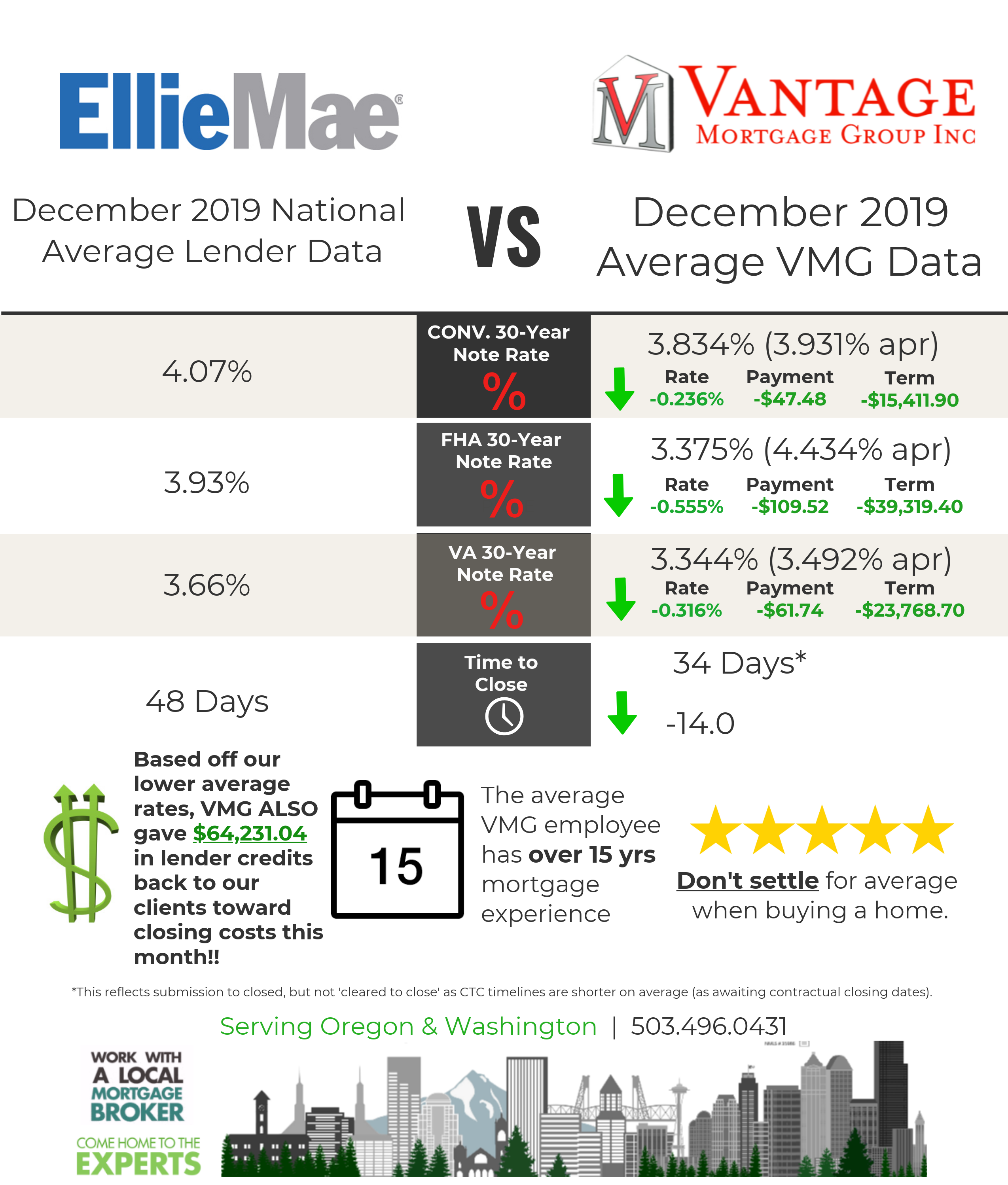

Over Half a Million Dollars in Lender Credits!

In 2019, Vantage Mortgage Group provided $553,084.53 in lender credits back to our clients toward closing costs and prepaids at settlement (optional rate sheet pricing to select from)… while also offering lower-than-average interest rates. We feel this math is important as the data shows competition always wins in primary mortgage origination. Facts and math support why we choose to remain independent as the top brokerage in Oregon, simply because it’s better in all ways for the clients we serve.

Data collected from Ellie Mae. Data compared to loan applications closed with Vantage Mortgage Group, Inc. during the calendar month and year noted above, along with the interest rate and APR information reflected. Comparisons made are for 30 year terms only on Conventional loans along with VA/FHA loans. Monthly payment and term savings based off $350,000 loan amount examples. Data is for informational purposes only and is not a rate quote or commitment to lend. Rates subject to change daily without notice. For a formal rate quote and loan approval, contact a VMG Loan Consultant at anytime and request a Loan Estimate.

Lender credits apply when a slightly higher interest rate is chosen, opposed to no lender credit or optional discount point buy-down at lower interest rates disclosed as an optional choice with VMG

Oregon & Washington Real Estate Update

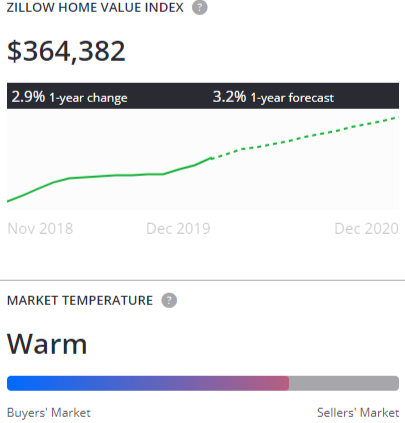

Oregon

The median home value in Oregon is $364,382. Oregon home values have gone up 2.9% over the past year and Zillow predicts they will rise 3.2% within the next year. The median list price per square foot in Oregon is $217. The median price of homes currently listed in Oregon is $379,000 while the median price of homes that sold is $347,500. The median rent price in Oregon is $1,800.

Foreclosures will be a factor impacting home values in the next several years. In Oregon 1.1 homes are foreclosed (per 10,000). This is lower than the national value of 1.2

Mortgage delinquency is the first step in the foreclosure process. This is when a homeowner fails to make a mortgage payment. The percent of delinquent mortgages in Oregon is 0.6%, which is lower than the national value of 1.1%. With U.S. home values having fallen by more than 20% nationally from their peak in 2007 until their trough in late 2011, many homeowners are now underwater on their mortgages, meaning they owe more than their home is worth. The percent of Oregon homeowners underwater on their mortgage is 4.1%.

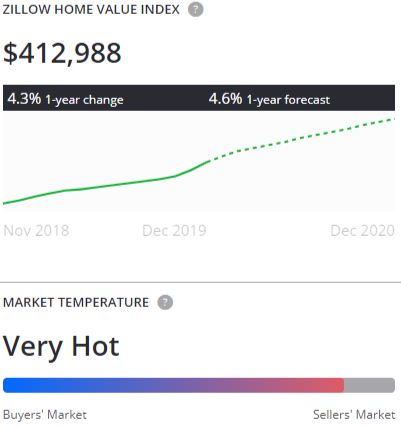

Washington

The median home value in Washington is $412,988. Washington home values have gone up 4.3% over the past year and Zillow predicts they will rise 4.6% within the next year. The median list price per square foot in Washington is $238. The median price of homes currently listed in Washington is $415,000 while the median price of homes that sold is $375,200. The median rent price in Washington is $1,995.

Foreclosures will be a factor impacting home values in the next several years. In Washington 0.8 homes are foreclosed (per 10,000). This is lower than the national value of 1.2

Mortgage delinquency is the first step in the foreclosure process. This is when a homeowner fails to make a mortgage payment. The percent of delinquent mortgages in Washington is 0.6%, which is lower than the national value of 1.1%. With U.S. home values having fallen by more than 20% nationally from their peak in 2007 until their trough in late 2011, many homeowners are now underwater on their mortgages, meaning they owe more than their home is worth. The percent of Washington homeowners underwater on their mortgage is 4.3%.

Mortgage Rate News & VMG Mortgage Rate Tracker

If you would like to be added to our VMG Weekly Rate Tracker, please contact us to request.

If you know of anyone buying a home now or in the near future, please share VMG with them.

To keep an eye on our market-leading mortgage rates or pass on to a friend or family member in the market to buy or refinance, visit our blog: https://vantagemortgagegroup.com/blog/