Vantage Mortgage Brokers hit a new milestone this month, reaching $2 Billion in loan production…

Summer 2023 Newsletter

MORTGAGE RATES, HOUSING & INFLATION

This continues to be a volatile and challenging year for mortgage rates and housing inventory. With inflation reaching its highest levels in 40 years last year, the rise in rates was quick and unforgiving. While many would-be home sellers exist, they don’t wish to double their mortgage rates and payments from what they currently have when locked at historic lows. This is what is causing the inventory shortage and home prices to remain stable. There were fewer homes for sale in May than any other month on record, according to Redfin. Combine this with a consumer debt load that has spiked by $2.9 Trillion since the end of 2019 and we can see why affordability is a factor.

Below is the year-to-date 10-Year Treasury Note candlestick chart showing the overall trend in mortgage rates. Clearly, we can see that economic data has created some volatility. We hit prior peaks in interest rates back around November of 2022. Shortly after we see there were some improvements in rates, yet then hit another peak in March of this year before falling again. Unfortunately, that was short-lived with a slow rise in rates that spiked this month in July from positive job numbers. There is some good news, however, that reflects recent signs of inflation slowing down. According to the latest Consumer Price Index (CPI) report, inflation cooled in June, growing at the slowest pace in over two years. This is welcome news and we can see the recent trends this past week of mortgage rate improvement that we really hope continues for would-be homebuyers, home shoppers, and sidelined would-be sellers.

To reiterate from the last newsletter, we greatly appreciate the support of our clients and business partners referring anyone to us that may be active in this market. Mortgage lenders are not created equal and competition is vital. As a fiduciary shopping the top wholesale lenders in the country on the same identical agency loans, the value in a market like today is priceless. Interest rates and the math associated with amortization schedules and monthly repayment amounts are vital today. As we’ve stated before, nearly half of borrowers don’t shop for their mortgage and lose out on thousands or tens of thousands of dollars in additional savings if they were to. Not only are we seeing massive rate margins and fees from retail lenders (nearly 90% of them out there), but the performance and mistakes made today creating contractual terminations are some of the highest we’ve seen. Again, thank you for the continued support of our long-time local team of experts and price leaders.

Reach out to a VMB team member for any questions on rate trends or scenarios.

WE ARE NOW LICENSED IN IDAHO!

You all spoke and we listened! Our recent licensing for the State of Idaho now wraps up the entire Pacific NW as our main focus area with our team of natives. We had many clients relocating to Idaho or having friends and family that reside there asking for our services. We are happy to now offer these services for those in or relocating to Idaho in addition to Oregon and Washington State.

OREGON HOUSING MARKET OVERVIEW

Typical Home Values:

$509,700

1-year Value Change:

-2.7%

(data through June 2023 via Redfin)

In June 2023, home prices in Oregon were down 2.7% compared to last year, selling for a median price of $509,700. On average, the number of homes sold was down 21.8% year over year and there were 4,825 homes sold in June this year, down 6,167 homes sold in June last year. The median days on the market was 46 days, up 33 year over year.

WASHINGTON HOUSING MARKET OVERVIEW

Typical Home Values:

$621,000

1-year Value Change:

-1.9%

(data through June 2023 via Redfin)

In June 2023, home prices in Washington were down 1.9% compared to last year, selling for a median price of $621,000. On average, the number of homes sold was down 28.1% year over year and there were 8,556 homes sold in June this year, down 11,893 homes sold in June last year. The median days on the market was 11 days, up 2 year over year.

IDAHO HOUSING MARKET OVERVIEW

Typical Home Values:

$459,900

1-year Value Change:

-6.6%

(data through June 2023 via Redfin)

In June 2023, home prices in Idaho were down 6.6% compared to last year, selling for a median price of $459,900. On average, the number of homes sold was down 7.8% year over year and there were 2,589 homes sold in June this year, down 2,817 homes sold in June last year. The median days on the market was 24 days, up 6 year over year.

2 QUESTIONS TO ASK YOURSELF IF YOU'RE CONSIDERING BUYING A HOME

If you’re thinking of buying a home, chances are you’re paying attention to just about everything you hear about the housing market. And you’re getting your information from a variety of channels: the news, social media, your real estate agent, conversations with friends and loved ones, overhearing someone chatting at the local supermarket, the list goes on and on. Most likely, home prices and mortgage rates are coming up a lot.

To help cut through the noise and give you the information you need most, take a look at what the data says. Here are the top two questions you need to ask yourself about home prices and mortgage rates as you make your decision:

1. Where Do I Think Home Prices Are Heading?

One reliable place you can turn to for that information is the Home Price Expectation Survey from Pulsenomics – a survey of a national panel of over one hundred economists, real estate experts, and investment and market strategists.

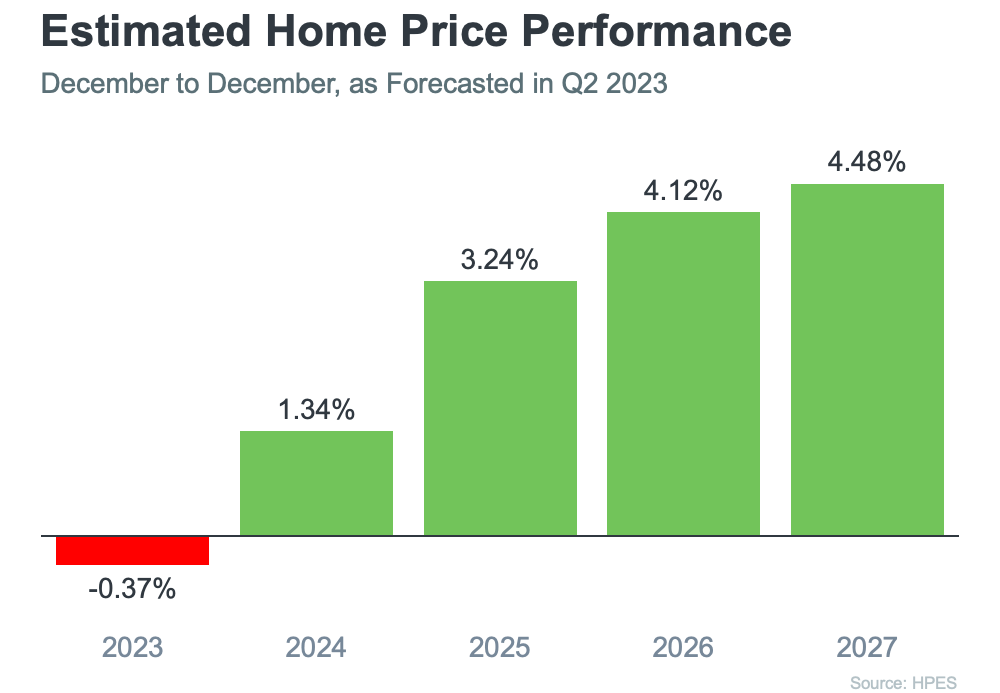

According to the latest release, the experts surveyed are projecting slight depreciation this year (see the red in the graph below). But here’s the context you need most. The worst home price declines are already behind us, and prices are actually appreciating again in many markets. Not to mention, the small 0.37% depreciation HPES is showing for 2023 is far from the crash some people originally said would happen.

Now, let’s look to the future. The green in the graph below shows prices have turned a corner and are expected to appreciate in 2024 and beyond. After this year, the HPES is forecasting home price appreciation returning to more normal levels for the next several years.

So, why does this matter to you? It means your home will likely grow in value and you should gain home equity in the years ahead, but only if you buy now. If you wait, based on these forecasts, the home will only cost you more later on.

2. Where Do I Think Mortgage Rates Are Heading?

Over the past year, mortgage rates have risen in response to economic uncertainty, inflation, and more. We know based on the latest reports that inflation, while still high, has moderated from its peak. This is an encouraging sign for the market and for mortgage rates. Here’s why.

When inflation cools, mortgage rates generally fall in response. This may be why some experts are saying mortgage rates will pull back slightly over the next few quarters and settle somewhere around roughly 5.5 and 6% on average.

But, not even the experts can say with absolute certainty where mortgage rates will be next year, or even next month. That’s because there are so many factors that can impact what happens. So, to give you a lens into the various possible outcomes, here’s what you should consider:

- If you buy now and mortgage rates don’t change: You made a good move since home prices are projected to grow with time, so at least you beat rising prices.

- If you buy now and mortgage rates fall (as projected): You probably still made a good decision because you got the house before home prices appreciated more. And, you can always refinance your home later on if rates are lower.

- If you buy now and mortgage rates rise: If this happens, you made a great decision because you bought before both the price of the home and the mortgage rate went up.

Bottom Line

If you’re thinking about buying a home, you need to know what’s expected with home prices and mortgage rates. While no one can say for certain where they’ll go, expert projections can give you powerful information to keep you informed.

THE REASON MORTGAGE RATES ARE SO HIGH

Today’s mortgage rates are top-of-mind for many homebuyers right now. As a result, if you’re thinking about buying for the first time or selling your current house to move into a home that better fits your needs, you may be asking yourself these two questions:

- Why Are Mortgage Rates So High?

- When Will Rates Go Back Down?

Here’s context you need to help answer those questions.

1. Why Are Mortgage Rates So High?

The 30-year fixed-rate mortgage is largely influenced by the supply and demand for mortgage-backed securities (MBS). According to Investopedia:

“Mortgage-backed securities (MBS) are investment products similar to bonds. Each MBS consists of a bundle of home loans and other real estate debt bought from the banks that issued them . . . The investor who buys a mortgage-backed security is essentially lending money to home buyers.”

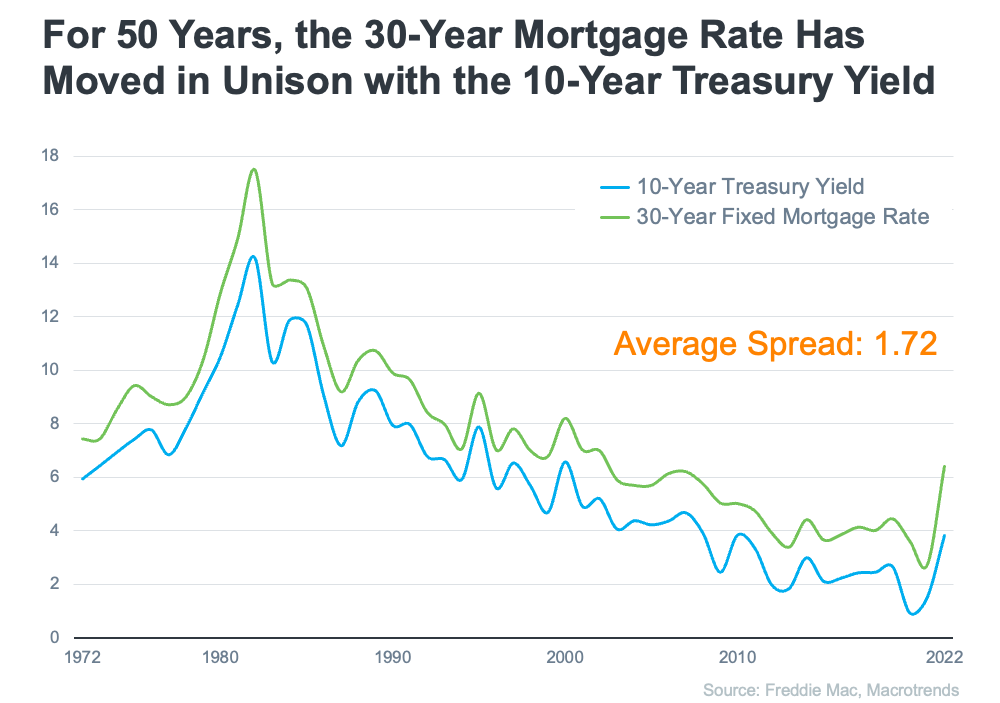

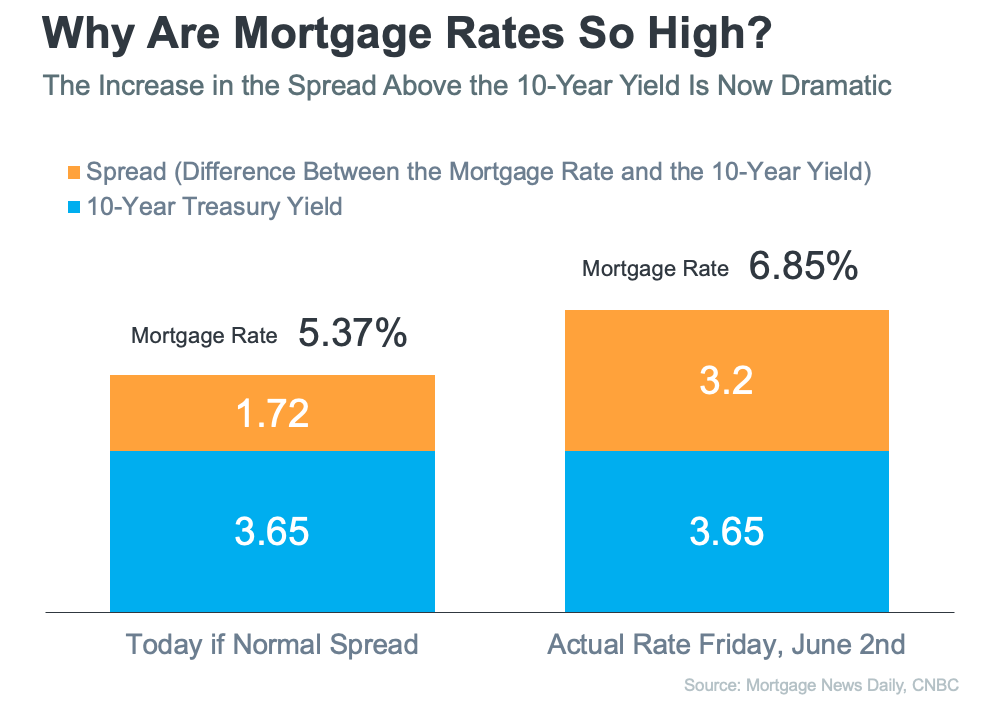

Demand for MBS helps determine the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate. Historically, the average spread between the two is 1.72 (see chart below):

Last Friday morning, the mortgage rate was 6.85%. That means the spread was 3.2%, which is almost 1.5% over the norm. If the spread was at its historical average, mortgage rates would be 5.37% (3.65% 10-Year Treasury Yield + 1.72 spread).

This large spread is very unusual. As George Ratiu, Chief Economist at Keeping Current Matters (KCM), explains:

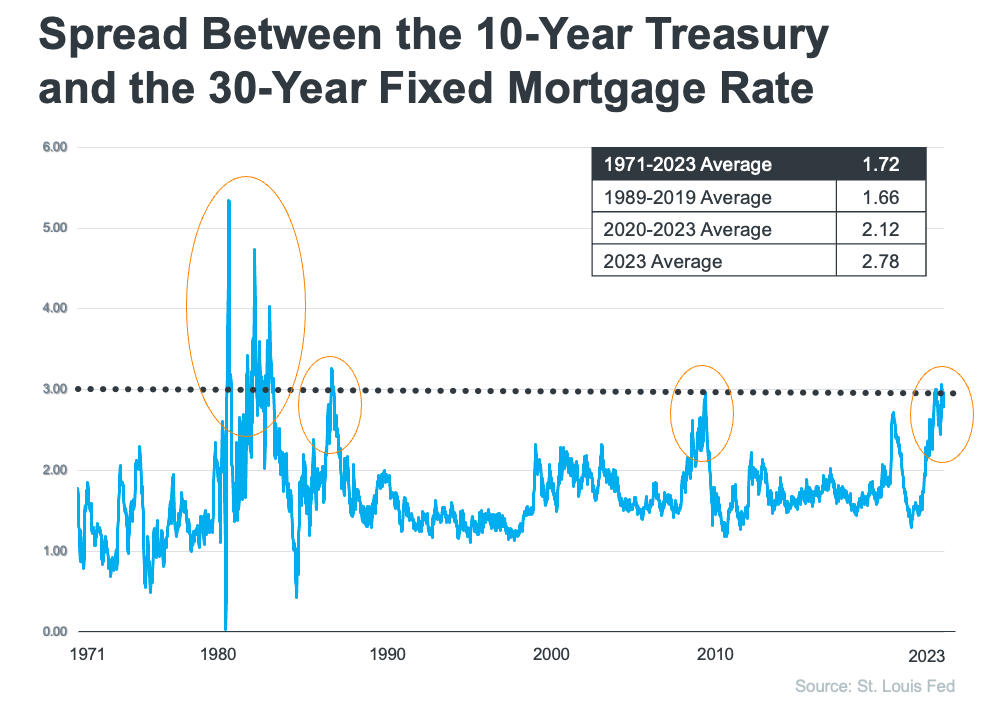

“The only times the spread approached or exceeded 300 basis points were during periods of high inflation or economic volatility, like those seen in the early 1980s or the Great Financial Crisis of 2008-09.”

The graph here uses historical data to help illustrate this point by showing the few times the spread has increased to 300 basis points or more.

The graph shows how the spread has come down after each peak. The good news is, that means there’s room for mortgage rates to improve today.

So, what’s causing the larger spread and making mortgage rates so high today?

The demand for MBS is heavily influenced by the risks associated with investing in them. Today, that risk is impacted by broader market conditions like inflation and fear of a potential recession, the Fed’s interest rate hikes to try to bring down inflation, headlines that create unnecessarily negative narratives about home prices, and more.

Simply put: when there’s less risk, demand for MBS is high, so mortgage rates will be lower. On the other hand, if there’s more risk with MBS, demand for MBS will be low, and we’ll see higher mortgage rates as a result. Currently, demand for MBS is low, so mortgage rates are high.

2. When Will Rates Go Back Down?

Odeta Kushi, Deputy Chief Economist at First American, answers that question in a recent blog:

“It’s reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal and provides investors with more certainty. However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.”

Bottom Line

The spread will shrink when the fear investors feel is eased. That’ll mean we should see mortgage rates moderate as the year goes on. However, when it comes to forecasting mortgage rates, no one can know for sure exactly what will happen.

As an ongoing reminder, we appreciate each and every one of our past clients, business partners, friends, and family during this market transition for their ongoing referrals.

Our fiduciary structure in the Pacific NW is extremely unique to shop and comparing the top wholesale lenders in the country to make sure they WIN in this market through shopping to get lower rates and fees. This can make a massive difference in the financial terms and outcome of a more competitive offer compared to so many that end up stuck with only one lender and no competition.

Please continue to share our information with those you know that are looking to buy a new home.