Fannie Mae & Freddie Mac have made an announcement clarifying some key details after the…

Vantage Mortgage Brokers’ Response to NAR settlement and support of Buyer’s Agents

In light of the NAR settlement, there is still plenty to work through on how lenders will handle this and the best ways to navigate this as a buyer’s agent. However, we wanted to give you a few resources to get a jump on it, and we will continue to provide information and be a vital resource as it becomes available. We also attended a Tom Ferry webinar recently, which provided some excellent information on how to help navigate this. Please review these details and resources and contact us with any questions.

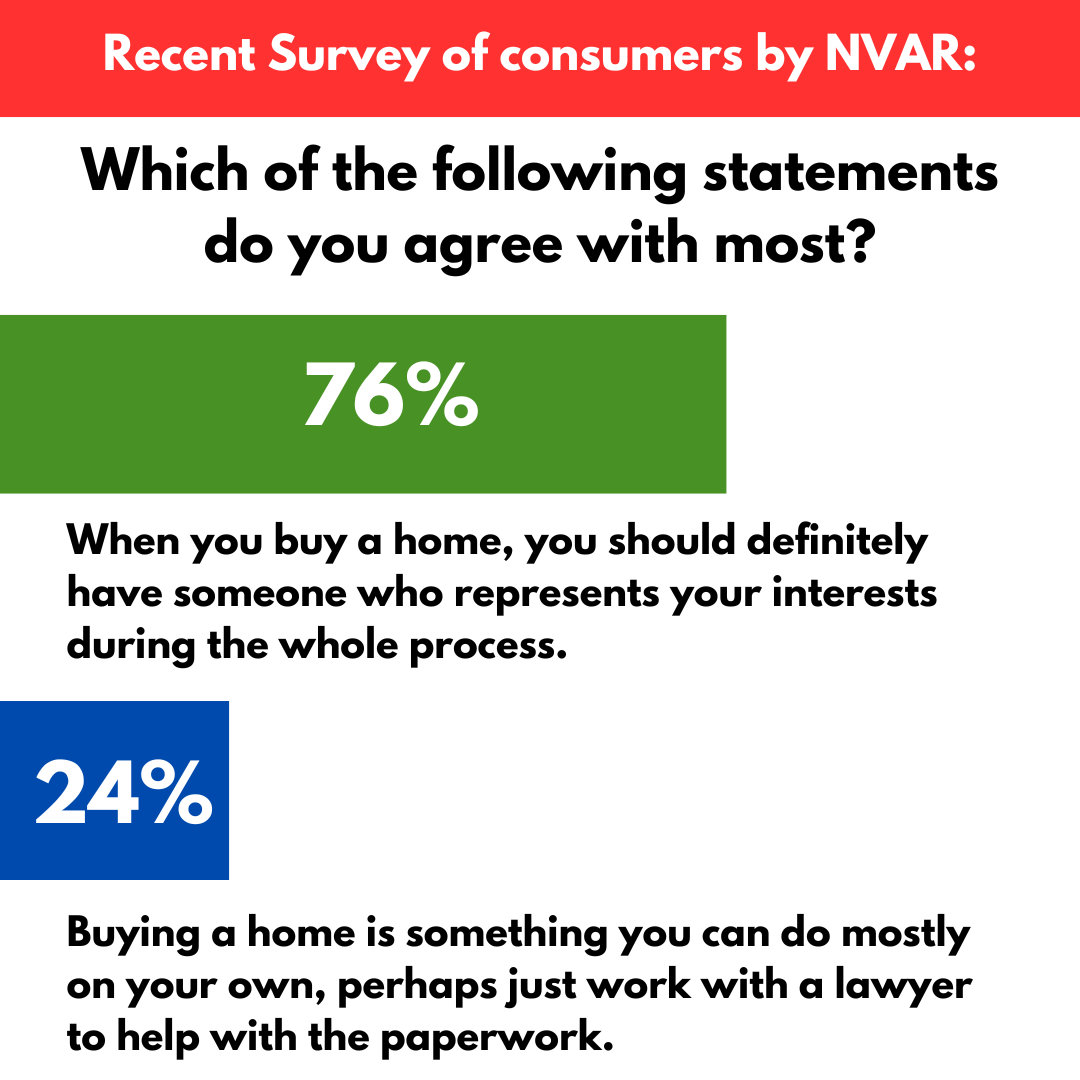

We assure you that this will be business as usual in the near future and just a change for everyone to adapt to. Not what the media is projecting. Buyer representation is vitally important.

Mortgage Industry Pending Response:

Please take a look at our seller concession cheat sheet here. Keep in mind that we are awaiting a response from the agencies to see if there will be more flexibility allowed on these % caps now that the buyer’s agent commission will be paid by the home buyer in addition to standard closing costs (if both are needing to be covered by the seller on occasional concession negotiations).

VA Loans – The VA must respond and confirm how it will handle this moving forward to ensure Veterans’ benefits are treated equally, not less competitively nor discriminated against. As it stands now, Veterans cannot pay a brokerage fee or commission fee.

Negotiating your Buyer’s agent commission:

The most preferred option is to have the seller pay the buyer’s agent commission through contractual negotiations or “Cooperative Compensation.” This will result in the best terms for the buyer to indirectly finance the cost versus paying out-of-pocket or covering through other means. Listing agents can prepare sellers for this anticipation for the most exposure and as a standard practice moving forward.

Alternative ideas/methods for Conventional and FHA loans (to cover some or all compensation):

- As a leading local independent mortgage broker, we use our knowledge of minimum down payment requirements to show examples of putting less down to free up more cash for buyers if necessary. Most consumers are surprised when they have a network of competing wholesale lending partners and how little of an impact even putting less down will have on the financial terms and affordability of the mortgage. This is the second favored option outside of the seller paying the compensation through financial coaching, shopping, and analysis of loan scenarios (not being captive to one lender’s options or views).

- Premium pricing is available in many scenarios through lender credits should the borrower use it to offset closing costs, one of which is the buyer agent representation commission. This is an option, yet less preferred, and we warn against any lenders that may come out with ‘special programs’ around agency commissions to motivate steering your clients to higher cost inferior loan options.

The bottom line is that Vantage Mortgage Brokers is committed to helping you and your buyers win in any market and help get them into their dream homes.

Don’t hesitate to get in touch with me anytime to maximize strategies as we navigate this change together. To ensure the clients we serve continue with the most favorable loan terms and buyer contractual negotiations together.

Below are a few notes from the Tom Ferry Webinar as well:

- The next 100 days are about Mindset, processes, contracts, and new conversations.

- We’re now applying for the job to represent buyers.

- Explain the contracts, listing side, buy side, title, escrow and attorneys regarding settlement.

- Share your supporting members of the transaction.

- Share the options of how you get paid a fee for your service.