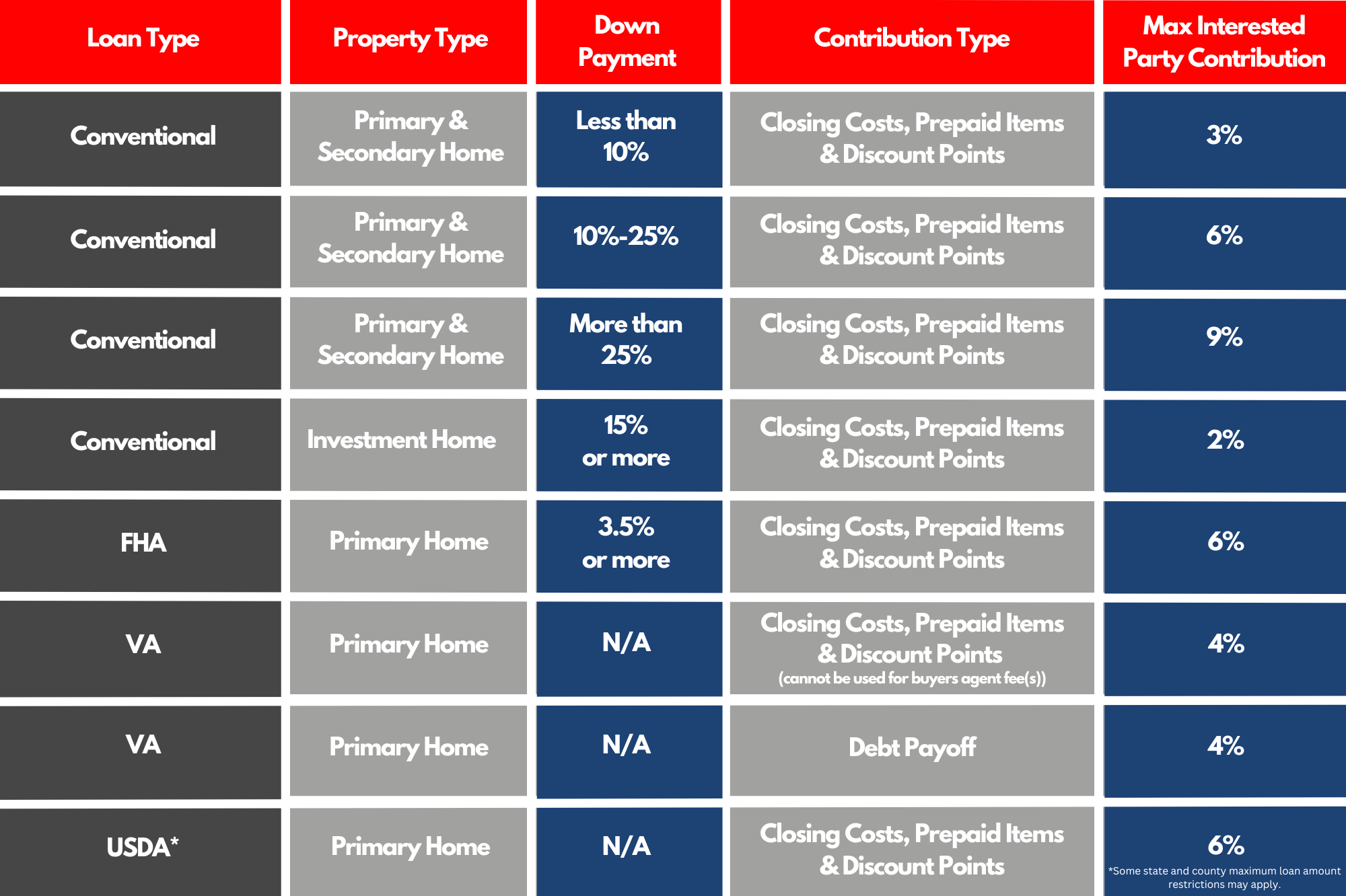

Many buyers opt to negotiate seller concessions in their purchase contract to cover any closing costs or prepaid taxes, insurance, and interest. This allows the buyer to produce only the minimum down payment, but may not require them to also come up with the closing costs out-of-pocket if paid by the seller.

There are limits as to the percentage (%) that a seller can credit to a buyer depending on the loan type. Certainly most situations won’t require these max concession amounts, but it’s good to know during the negotiation phase. Your VMG Loan Consultant can provide the best advice when negotiating credits and the amount to request if so. You can also receive Lender Credits to cover some or all closing costs, but this will have an impact on your interest rate chosen. You will want to discuss all interest rates and cost/credit options in which you qualify for with your Loan Consultant. Recapture analysis and understanding the benefits in lender credits is a very important part of rate lock and loan comparison.

There are limits as to the percentage (%) that a seller can credit to a buyer depending on the loan type. Certainly most situations won’t require these max concession amounts, but it’s good to know during the negotiation phase. Your VMG Loan Consultant can provide the best advice when negotiating credits and the amount to request if so. You can also receive Lender Credits to cover some or all closing costs, but this will have an impact on your interest rate chosen. You will want to discuss all interest rates and cost/credit options in which you qualify for with your Loan Consultant. Recapture analysis and understanding the benefits in lender credits is a very important part of rate lock and loan comparison.

Below are the limits expressed as a percentage of the sales price or appraised value with Loan-to-Value (LTV) ratios: