Vantage Mortgage Brokers Fall 2023 Newsletter

Continued Inflationary Pressure on Mortgage Rates and Housing

Mortgage rates have continued to rise and hit a year-to-date peak in recent weeks that we have not seen for over 23 years. We hope that this peak is now in our rear-view mirror and we’re through the worst of it, but inflation data each month has not shown favorable signs that it is decreasing at a fast enough rate. As a result of sustained elevated rates, mortgage applications are down across the country and the real estate market is feeling the pressures of the lowest affordable housing on record.

Our team at Vantage Mortgage Brokers continues to support our clients (and those they refer) and deliver a unique platform compared to other mortgage providers (important in all markets, but especially today).

It is still a good time to buy if people can afford it and we are doing some of the following to support this current market today and beyond:

- Financial Education. We analyze and review the full financial picture to help strategize the best way to secure any new mortgage debt. Most wealth in the United States is derived from real estate and equity growth so we help suggest how to best allocate your budget and debts to be comfortable with your new mortgage terms. Every household budget must analyze favorable and non-favorable debts and how to allocate or invest in all assets, especially when it comes to housing.

- Lender Competition & More Options. Simply put, more lenders and more rate sheets to shop.. equates to lower rates and fees. This also exposes more programs and options to help qualify more borrowers at terms they can afford. This lending climate is requiring many lenders to merge, get acquired, or simply go out of business. Lender rates are also extremely volatile on the same identical agency loans so our ability to navigate and quickly pivot with the click of a mouse is vital. We are not impacted by significant changes lenders face and have the ability to quickly compare and adapt so that our client’s approvals and contracts are not at risk if we were captive to a lender as so many are today.

- Strategic Offers with Seller Credits. With any possible negotiation in price, we’re showing the math that favors seller credits in lieu (or in addition to) a price reduction. These credits can be used to directly save more cash to cover some or all closing costs and prepaids, along with temporary or permanent interest rate buy-downs. The temporary buy-down has been around for a long time but is becoming a more popular strategy for those buying in this rate environment. We also have other strategies to help show the strength of your offer to potential sellers.

- Educational Content and Videos. We provide full access to programs, products, educational videos, and material on our website right at the consumer’s fingertips without the requirement to fill out information like so many others. Education is key and the better informed and educated a consumer is, the better. This will also show and discuss special programs for first-time buyers and repeat buyers if any offer rate discounts to help with mortgage payments relating to median income, etc.

- No Hassle Fast Second Opinion. Many buyers feel like they are stuck on their financing and don’t realize just how different the rates can be if they were to shop (and that they have the legal right to). Most complete an application with one lender or have a Realtor refer one lender.. not realizing the vital importance that they shop which could save them thousands or tens of thousands of dollars. Today especially this is very important even if they are already under contract. While we can turn applications and pre-approval letters around same-day, we don’t need a full application to quickly run an analysis and show them these savings. A few questions are all it takes.

The Fed Is Likely Done With Interest Rate Hikes

MBA Forecast: Better days may be ahead for U.S. mortgage rates

The Federal Reserve may reach its 2% inflation target rate by early 2025 and it is likely done with its restrictive monetary policy, Mike Fratantoni, Mortgage Bankers Association (MBA) chief economist and senior vice president, said at the Market Outlook session on Sunday at the MBA Annual Conference in Philadelphia.

Fratantoni said he did not expect the central bank would raise interest rates in November and said there was a minimal chance they would do so in December. He is also anticipating that the central bank will cut interest rates three times in 2024.

The 10-year treasury rate, which reached a new high of 4.8% recently, is also expected to start reversing course and drop below 4% by the end of the year and into a neutral rate within the 3.5% range, Fratantoni said. That’s good news for mortgage rates, which recently saw the 30-year soar to 7.57%. Fratantoni said he expected mortgage rates to begin trending down over the next two years.

“This is the bottom of the cycle,” Fratantoni said.

“Our view is that the Fed’s done and they’re going to stick at this 5.25% to 5.5% fund rate,” Fratantoni said. “This does run counter to their suggestion at their last meeting in September, where they put out projections saying median members still think one more hike, but if you listen to the speeches that they’ve given the last couple of weeks, even some of the more hawkish members are saying long end of the curve has increased so much that’s doing our work for us and we probably don’t need to hike anymore right now.”

Pacific Northwest Housing Market Overview

Median Sale Price

$502,000

-0.47% year-over-year

# of Homes Sold

3,872

-22.8% year-over-year

Median Days on Market

29

0 year-over-year

In September 2023, home prices in Oregon were down 0.47% compared to last year, selling for a median price of $502,000. On average, the number of homes sold was down 22.8% year over year and there were 3,872 homes sold in September this year, down 5,015 homes sold in September last year. The median days on the market was 29 days.

Median Sale Price

$603,000

+2.3% year-over-year

# of Homes Sold

7,069

-28.5% year-over-year

Median Days on Market

18

-7 year-over-year

In September 2023, home prices in Washington were up 2.3% compared to last year, selling for a median price of $603,000. On average, the number of homes sold was down 28.5% year over year and there were 7,069 homes sold in September this year, down 9,891 homes sold in September last year. The median days on the market was 18 days, down 7 year over year.

Median Sale Price

$467,000

+0.7% year-over-year

# of Homes Sold

2,218

-11.9% year-over-year

Median Days on Market

36

-4 year-over-year

In September 2023, home prices in Idaho were up 0.7% compared to last year, selling for a median price of $467,000. On average, the number of homes sold was down 11.9% year over year and there were 2,218 homes sold in September this year, down 2,519 homes sold in September last year. The median days on the market was 36 days, down 4 year over year.

Today's Housing Market Has Only Half The Usual Inventory

There are only about half the number of homes for sale compared to the last normal years in the market.

That means buyers don’t have enough options right now. So, if you work with an agent to list your house, it should be in the spotlight.

If you’re thinking of selling, get in touch with a local real estate agent so your house can stand out while there’s such a shortage of supply and buyers are craving more options.

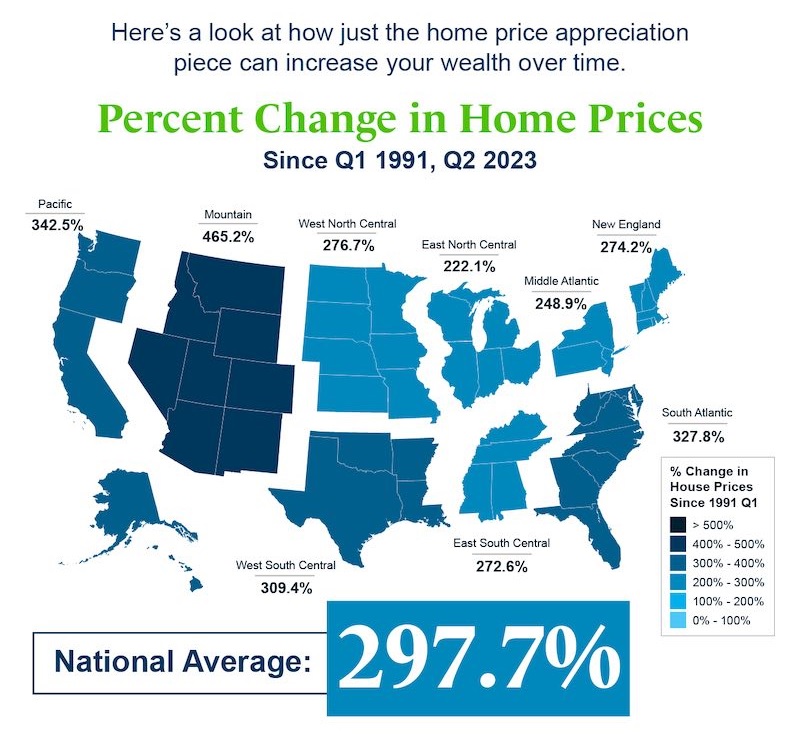

How Homeowner Net Worth Grows with Time

If you’re thinking about buying a home this year, be sure to consider the long-term financial advantages of homeownership, like home equity.

Home Equity is the current value of your home minus what you still owe on your loan. It goes up when you pay down your loan and home price appreciation makes your home’s value go up.

On average, people who bought homes 32 years ago have seen their home’s value nearly triple over that time.

If you’re wondering if buying a home is a good idea, remember rising home values could grow your net worth with time. When you’re ready to start your homebuying journey, talk with a local real estate professional.

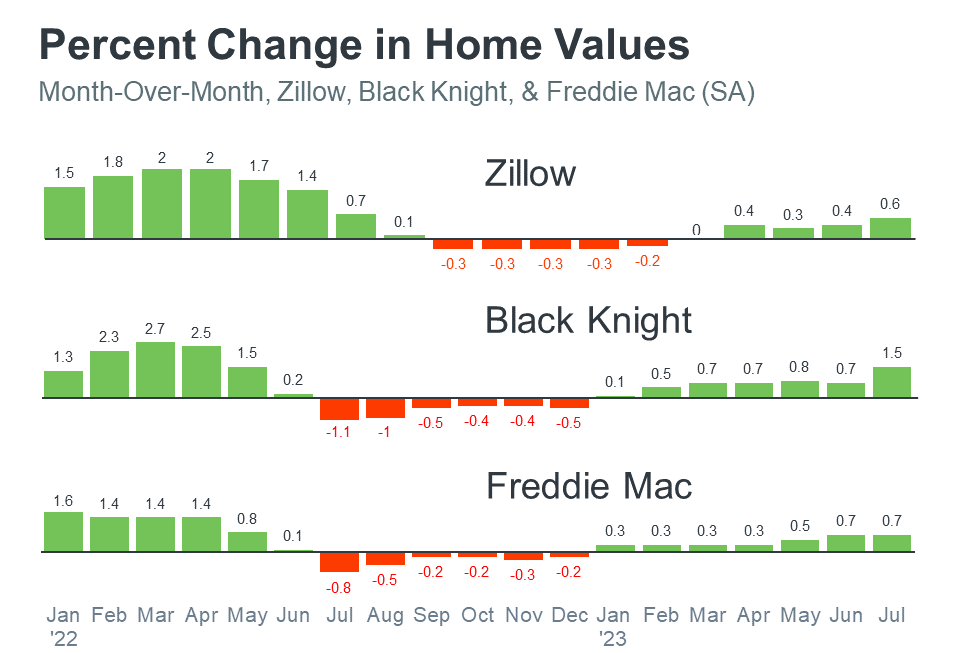

Home Prices Are Not Falling

Home prices never crashed. The actual data shows home prices were remarkably resilient and performed far better than the media would have you believe.

Don’t let the headlines scare you or delay your plans. Lean on your Mortgage Consultant and Real Estate professional so you have a trusted resource to cut through the noise and tell you what’s really happening in your area.

We Appreciate Your Business

Thank you so much for referring your friends, family, and co-workers to us when you hear they are in the market to buy a home or refinance. We greatly appreciate it and rely on these referrals to best serve all in the Pacific NW.

To reiterate from the last newsletter, we greatly appreciate the support of our clients and business partners referring anyone to us who may be active in this market. Mortgage lenders are not created equal and competition is vital. As a fiduciary shopping the top wholesale lenders in the country on the same identical agency loans, the value in a market like today is priceless. Interest rates and the math associated with amortization schedules and monthly repayment amounts are vital today. Again, thank you for the continued support of our long-time local team of experts and price leaders.

Reach out to a VMB team member for any questions on rate trends or scenarios.