Vantage Mortgage Brokers hit a new milestone this month, reaching $2 Billion in loan production…

Vantage Mortgage Brokers Winter 2024 Newsletter

Happy New Year!

As we bid farewell to the old year and welcome the new one, we want to thank all of you for the support you’ve shown us over the last 16 years as past clients, business partners, friends, family, and colleagues. We greatly appreciate your referrals for those you know seeking a mortgage in Oregon, Washington, and Idaho. We rely on this support and work hard to produce unmatched service, experience, and the most competitive rates and terms to continue earning it.

As many of you know, the last two years have been the most challenging the mortgage industry has seen. Even more so than after the 2008 financial crisis, as this inflationary pressure on interest rates, inventory, and volume has lasted much longer. We anticipate 2024 to improve over 2023 with rates and housing affordability also improving, but we again much appreciate your referrals to our independent and unique services and are humbled to receive them.

May the coming year bring you joy, prosperity, and abundant opportunities. We look forward to building upon our relationship and creating more value for your personal finances and your business. Thank you for being an integral part of our journey.

Mortgage Rate Trends

We continue to closely monitor mortgage rates, inflationary pressures, and trends and share some predictions for what 2024 may hold, with many unknown variables that can create volatility. Mortgage rates peaked at their highest levels in over 20 years near the end of October and the beginning of November last year (as you can see in our graph of the 10-Year Treasury Note). Since that time, we’ve seen an improvement of approximately 1.5% from the peak, greatly helping with affordability. One recent analysis showed a buyer’s payment drop of nearly $800/mo in just a few months compared to a scenario running at the peak during their home search.

The Federal Reserve recently stated that interest rate cuts are likely in 2024. There is still uncertainty, of course. Monthly economic reports on inflation, jobs, and overall stability will determine what measures will be taken. We also have an election later this year, foreign wars, and other unknown origins of market turmoil that we will continue to monitor and update throughout the year.

Federal Reserve officials in December concluded that interest rate cuts are likely in 2024, though they appeared to provide little in the way of when that might occur, according to minutes from their latest meeting.

Economists predict the real estate market will recover in 2024 after a spike in mortgage rates and a shortage of properties sent sales tumbling to a 28-year low in 2023.

Home sales likely will climb 14% this year according to some Economists. That would be the biggest annual gain in more than four decades, according to the National Assoc. of Realtor data.

Median Sale Price

$490,200

+0.09% year-over-year

# of Homes Sold

3,093

-13.0% year-over-year

Median Days on Market

38

+5 year-over-year

In November 2023, home prices in Oregon were up 0.09% compared to last year, selling for a median price of $490,200. On average, the number of homes sold was down 13.0% year over year and there were 3,093 homes sold in November this year, down 3,557 homes sold in November last year. The median days on the market was 38 days, up 5 year over year.

Median Sale Price

$605,200

+6.7% year-over-year

# of Homes Sold

5,642

-16.9% year-over-year

Median Days on Market

26

-3 year-over-year

In November 2023, home prices in Washington were up 6.7% compared to last year, selling for a median price of $605,200. On average, the number of homes sold was down 16.9% year over year and there were 5,642 homes sold in November this year, down 6,789 homes sold in November last year. The median days on the market was 26 days, down 3 year over year.

Median Sale Price

$479,800

+4.9% year-over-year

# of Homes Sold

1,803

-5.4% year-over-year

Median Days on Market

46

-9 year-over-year

In November 2023, home prices in Idaho were up 4.9% compared to last year, selling for a median price of $479,800. On average, the number of homes sold was down 5.4% year over year and there were 1,803 homes sold in November this year, down 1,910 homes sold in November last year. The median days on the market was 46 days, down 9 year over year.

Expert Quotes On The 2024 Housing Market Forecast

If you’re thinking about buying or selling a home soon, you probably want to know what you can expect from the housing market in 2024. In 2023, higher mortgage rates, confusion over home price headlines, and a lack of homes for sale created some challenges for buyers and sellers looking to make a move. But what’s on the horizon for the new year?

The good news is, many experts are optimistic we’ve turned a corner and are headed in a positive direction.

Mortgage Rates Expected To Ease

Recently, mortgage rates have started to come back down. This has offered hope to buyers dealing with affordability challenges. Mark Fleming, Chief Economist at First American, explains how they may continue to drop:

“Mortgage rates have already retreated from recent peaks near 8 percent and may fall further . . .”

Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says:

“For home buyers who are taking on a mortgage to purchase a home and have been wary of the autumn rise in mortgage rates, the market is turning more favorable, and there should be optimism entering 2024 for a better market.”

The Supply of Homes for Sale May Grow

As rates ease, activity in the housing market should pick up because more buyers and sellers who had been holding off will jump back into action. If more sellers list, the supply of homes for sale will grow – a trend we’ve already started to see this year. Lisa Sturtevant, Chief Economist at Bright MLS, says:

“Supply will loosen up in 2024. Even homeowners who have been characterized as being ‘locked in’ to low rates will increasingly find that changing family and financial circumstances will lead to more moves and more new listings over the course of the year, particularly as rates move closer to 6.5%.”

Home Price Growth Should Moderate

And mortgage rates pulling back isn’t the only positive sign for affordability. Home price growth is expected to moderate too, as inventory improves but is still low overall. As the Home Price Expectation Survey (HPES) from Fannie Mae, a survey of over 100 economists, investment strategists, and housing market analysts, says:

“On average, the panel anticipates home price growth to clock in at 5.9% in 2023, to be followed by slower growth in 2024 and 2025 of 2.4 percent and 2.7 percent, respectively.”

To wrap it up, experts project 2024 will be a better year for the housing market. So, if you’re thinking about making a move next year, know that early signs show we’re turning a corner. As Mike Simonsen, President and Founder of Altos Research, puts it:

“We’re going into 2024 with slight home-price gains, somewhat easing inventory constraints, slightly increasing transaction volume . . . All in all, things are looking up for the U.S. housing market in 2024.”

Bottom Line

Experts are optimistic about what 2024 holds for the housing market. If you’re looking to buy or sell a home in the new year, the best way to ensure you’re up to date on the latest forecasts is to partner with a trusted mortgage broker and real estate agent.

The Surprising Trend In The Number Of Homes Coming Onto The Market

If you’re thinking about moving, it’s important to know what’s happening in the housing market. Here’s an update on the supply of homes currently for sale. Whether you’re buying or selling, the number of homes in your area is something you should pay attention to.

In the housing market, there are regular patterns that happen every year, called seasonality. Spring is the peak homebuying season and also when the most homes are typically listed for sale (homes coming onto the market are known in the industry as new listings). In the second half of each year, the number of new listings typically decreases as the pace of sales slows down.

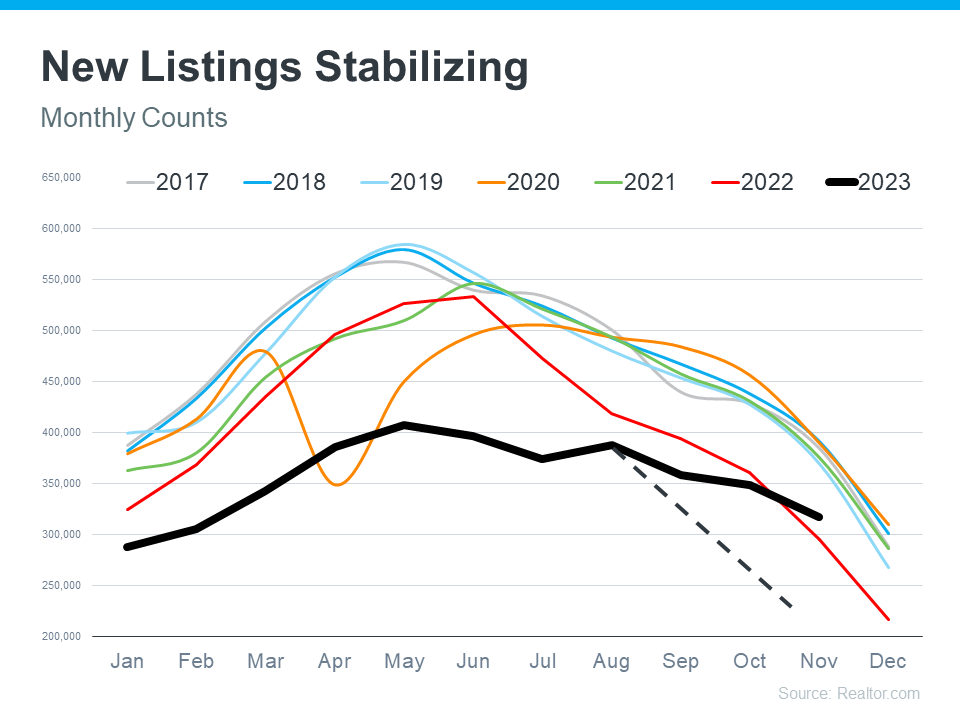

The graph below uses data from Realtor.com to provide a visual of this seasonality. It shows how this year (the black line) is breaking from the norm (see graph below):

Looking at this graph, three things become clear:

- 2017-2019 (the blue and gray lines) follow the same general pattern. These years were very typical in the housing market and their lines on the graph show normal, seasonal trends.

- Starting in 2020, the data broke from the normal trend. The big drop down in 2020 (the orange line) signals when the pandemic hit and many sellers paused their plans to move. 2021 (the green line) and 2022 (the red line) follow the normal trend a bit more, but still are abnormal in their own ways.

- This year (the black line) is truly unique. The steep drop off in new listings that usually occurs this time of year hasn’t happened. If 2023 followed the norm, the line representing this year would look more like the dotted black line. Instead, what’s happening is the number of new listings is stabilizing. And, there are even more new listings coming to the market this year compared to the same time last year.

What Does This Mean for You?

- For buyers, new listings stabilizing is a positive sign. It means you have a more steady stream of options coming onto the market and more choices for your next home than you would have at the same time last year. This opens up possibilities and allows you to explore a variety of homes that suit your needs.

- For sellers, while new listings are breaking seasonal norms, inventory is still well below where it was before the pandemic. If you look again at the graph, you’ll see the black line for this year is still lower than normal, meaning inventory isn’t going up dramatically and prices aren’t heading for a crash. And with less competition from other sellers than you’d see in a more typical year, your house has a better chance to be in the spotlight and attract eager buyers.

Bottom Line

Whether you’re on the hunt for your next home or thinking of selling, now might just be the perfect time to make your move.

We Appreciate Your Business

Thank you so much for referring your friends, family, and co-workers to us when you hear they are in the market to buy a home or refinance. We greatly appreciate it and rely on these referrals to best serve all in the Pacific NW.

To reiterate from the last newsletter, we greatly appreciate the support of our clients and business partners referring anyone to us who may be active in this market. Mortgage lenders are not created equal and competition is vital. As a fiduciary shopping the top wholesale lenders in the country on the same identical agency loans, the value in a market like today is priceless. Interest rates and the math associated with amortization schedules and monthly repayment amounts are vital today. Again, thank you for the continued support of our long-time local team of experts and price leaders.

Reach out to a VMB team member for any questions on rate trends or scenarios.