Competition between lenders drives down costs and improves performance due to several key economic principles:…

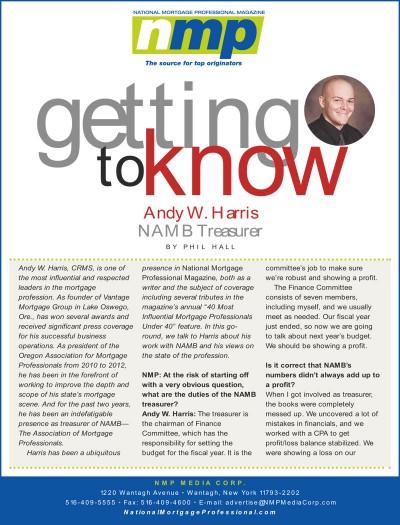

Getting To Know Vantage President Andy Harris.

Article from National Mortgage Professional Magazine:

Andy W. Harris, CRMS, is one of the most influential and respected leaders in the mortgage

profession. As founder of Vantage Mortgage Group in Lake Oswego, Ore., has won several awards and received significant press coverage for his successful business operations. As president of the Oregon Association for Mortgage Professionals from 2010 to 2012, he has been in the forefront of working to improve the depth and scope of his state’s mortgage scene. And for the past two years, he has been an indefatigable presence as treasurer of NAMB—The Association of Mortgage Professionals.

Harris has been a ubiquitous presence in National Mortgage Professional Magazine, both as a writer and the subject of coverage including several tributes in the magazine’s annual “40 Most Influential Mortgage Professionals Under 40” feature. In this goround, we talk to Harris about his work with NAMB and his views on the state of the profession.

CLICK IMAGES TO ENLARGE THE ARTICLE

NMP: At the risk of starting off

with a very obvious question,

what are the duties of the NAMB

treasurer?

Andy W. Harris: The treasurer is the chairman of the Finance Committee, which has the

responsibility for setting the

budget for the fiscal year. It is the

committee’s job to make sure

we’re robust and showing a profit.

The Finance Committee consists of seven members,including myself, and we usually meet as needed. Our fiscal year just ended, so now we are going to talk about next year’s budget. We should be showing a profit.

Is it correct that NAMB’s

numbers didn’t always add up to a profit?

When I got involved as treasurer,

the books were completely

messed up. We uncovered a lot of

mistakes in financials, and we

worked with a CPA to get

profit/loss balance stabilized. We

were showing a loss on our

national show in Las Vegas. Since

then, we’ve showed a significant

profit and maintained good

liquidity. Obviously, this helped the association.

But this is a huge responsibility. What attracted you to this aspect of NAMB?

When I first spoke with the

Nomination Committee, everyone

thought I’d have good patience in

this position. I would tell everyone

looking at the books, “Would you

do this in your own business?”

Also, I like numbers.

People have a sense of how

we’ve changed things and are

using common sense. Before,

there was a lack of participation.

Now, finances are getting

discussed. We always have the

Finance Committee agree and vote

on certain things, making sure it

benefits the members.

In your work on the NAMB Executive Board, you have also been active in representing the organization in Washington, D.C.

It is great for anyone in the organization to see Washington, D.C., and to understand how it relates to our business. My first visit there was an eye opener, as I was able to go through halls of Congress and speak with lawmakers. It’s priceless to be able to be directly involved with it.

One of the big challenges facing NAMB’s leadership is expanding the organization’s membership. Why should mortgage professionals become part of NAMB?

If you have a passion for this business and see your work as more of a career than a job, you

need to ask how you can participate in this business to make it better. We have an industry that lacks participation. I hope more people join in the future—it is one of the most frustrating things.

Why do you think more people have not become involved?

There could be a misunderstanding of what NAMB does. In our name, “B” stands for “Broker,” but our name is also the Association of Mortgage Professionals. That is a little bit

confusing. And if you look at board of NAMB, we have more bankers than brokers.

You’ve also held leadership roles in your state association. How do you compare the state experience versus the national experience?

There are good things in both. At the state level, there are more local colleagues to work with. At the national, it is macro-level versus micro-level. Macro is more fulfilling, at least to me, and I get a different perspective.

Do you see yourself taking on higher level executive roles at NAMB in the near future?

For right now, I plan to remain another year as treasurer. For the future, it is hard to say. My

schedule is very tight. I originate and I am busy, so I am not able to serve at this point in high

executive positions. I’m inundated with business, which is not necessarily a bad thing.

Phil Hall is managing editor of

National Mortgage Professional

Magazine. He may be reached by email

at philh@nmpmediacorp.com.