By Andy Harris, President of Vantage Mortgage Brokers

Mortgage loan debate: Stick with a bank or go with a broker?

Mortgage loan debate: Stick with a bank or go with a broker?

Article from Bankrate.com

Mortgage brokers took a hit following the 2008 financial crisis.

Point-counterpoint:

Mortgage brokers vs. bankers

Brokers

Mat Ishbia

President and CEO of United Wholesale Mortgage

Bankers

Tom Gamache

Northeast Division Manager, Home Lending Solutions, Citizens Bank

They came under greater regulation by the Consumer Financial Protection Bureau, some major bankers stopped working with them and their ranks dwindled, according to Mortgage Professional America.

But banks have suffered their own troubles with regulators and the public.

In June, 6 banks were cited for ignoring requests for loan modifications or failing to make good-faith efforts to prevent foreclosures, while regional banks continue to be hit with investigations by the Justice Department for bad underwriting of Federal Housing Administration loans, according to National Mortgage News.

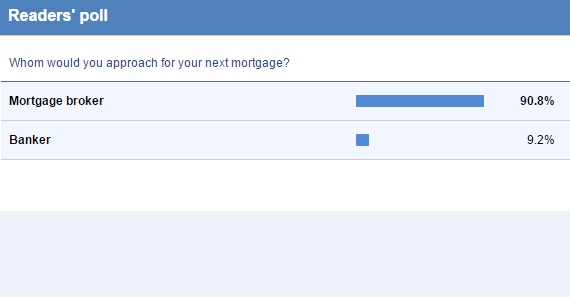

Whom would you approach for your next mortgage? Who would find the right mortgage and the best rate for you? And, whom would minimize the hassle of the mortgage approval process?

Experts representing mortgage brokers and mortgage bankers make their claims as to why they deserve your trust — and business.

Mortgage brokers

By Mat Ishbia

Mortgage brokers are licensed residential mortgage professionals with access to hundreds of loan options for consumers looking to buy or refinance a home. They support borrowers by leveraging relationships and securing the most favorable loan options available. Brokers can help homeowners save thousands of dollars on what is likely the most important financial undertaking of their lives.

Brokers streamline the loan-shopping process by promptly lining up multiple options that borrowers would likely qualify for to allow borrowers to choose the best option for themselves.

While larger lending institutions serve customers, they are not focused specifically on residential mortgage lending. They focus on auto, boat and personal loans, just to name a few. They are not focused on 1 area of expertise: mortgages. Large retail lending institutions can only offer the loan products they have in house, and most often pricing is higher because of the overhead associated with larger institutions and banks.

Brokers, including local banks and credit unions, are typically smaller and more nimble; they adapt to change quickly and have less overhead to be more competitive in the mortgage market. Furthermore, the commission structure for a broker is highly regulated and broker originators have the same pay structure on all loans, no matter what type of loan or loan size.

Read more about what Mat has to say …

Mortgage bankers

By Tom Gamache

Buying your own home is probably the largest and most important financial decision that any of us will ever make.

To help make that monumental decision, the vast majority of people turn to their bank for a loan rather than to a mortgage broker.

Securing a mortgage offer based on your existing banking relationship can result in a lower interest rate, not just an opportunity during a one-off transaction with an unfamiliar lender.

The reason is pretty simple: Most people already have a relationship with their bank, which has become a trusted partner after providing a range of services over the years, including a credit card, checking account and savings account.

By comparison, a mortgage broker is typically a 3rd-party organization with which you would have had no previous dealings.

You will be unfamiliar with your potential broker, but more importantly they will not know much about you. And that can really influence the kind of deals they offer. Citizens Bank in particular works hard to make banking relationships with customers personal.

On that same note, your bank already knows a great deal of information about you, such as the balances on your checking and savings accounts, and that can help make qualifying for a mortgage a lot easier.