Fall Newsletter 2022

After an amazing extension to the summer weather through mid-October, that has certainly changed quickly in the Pacific NW with cool air and rain anticipated now in the extended forecast.

Speaking of rain, inflation continues to rain down on our economy. As a result, many of you are feeling this everywhere (gas, food, etc.). Unfortunately, those that are financing homes are also feeling it quite heavily. Inflation and mortgage rates don’t mix well. We’ve seen the highest rates (at a rapid pace this year) since about 2007 with over 40-year high inflation. While the Fed is trying to get inflation under control, the action was too late and we’re likely headed into a recession. For those buying and financing today, they likely will be refinancing in the next 1-2 years, but time will tell.

Homebuying opportunities are still here using math and being focused on affordability, no matter what the media says. We’re not going to experience any great housing crash like in 2008 as this is a very different situation. This is an inflation issue, not a subprime mortgage and credit crisis issue directly impacting the housing sector. Most everyone buying today is fully vetted on the ability to repay with skin in the game and meet criteria that didn’t apply before. Default rates will be lower and homeownership still builds wealth as we’ve seen in every generation.Today, more than ever, homebuyers must get the best education possible when seeking a mortgage. Education is key and shopping for their loan is vital. As always, we are here for any questions or market updates for anyone and everyone.

We created a great educational video below we hope you share with anyone you know that is in the market to buy or refinance now or in the future, and greatly appreciate and rely on your referrals as a local small business.

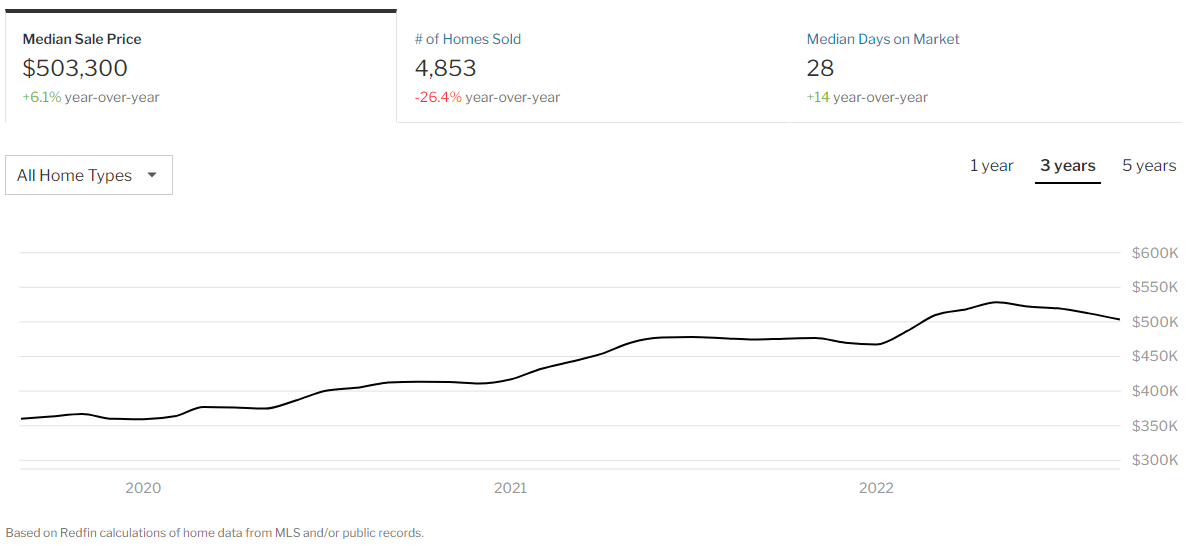

Oregon Housing Market Overview

What is the housing market like right now?

In September 2022, home prices in Oregon were up 6.1% compared to last year, selling for a median price of $503,300. On average, the number of homes sold was down 26.4% year over year and there were 4,853 homes sold in September this year, down 6,585 homes sold in September last year. The median days on the market was 28 days, up 14 year over year.

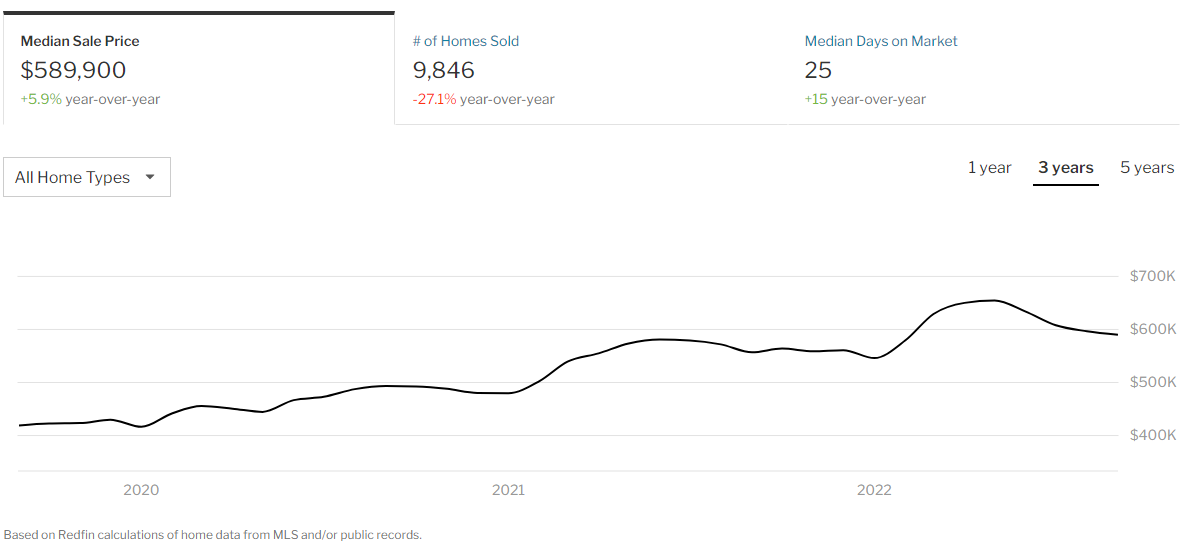

Washington Housing Market Overview

What is the housing market like right now?

What’s Ahead For Home Prices?

As the housing market cools in response to the dramatic rise in mortgage rates, home price appreciation is cooling as well. And if you’re following along with headlines in the media, you’re probably seeing a wide range of opinions calling for everything from falling home prices to ongoing appreciation. But what’s true? What’s most likely to happen moving forward?

While opinions differ, the most likely outcome is we’ll fall somewhere in the middle of slight appreciation and slight depreciation. Here’s a look at the latest expert projections so you have the best information possible today.

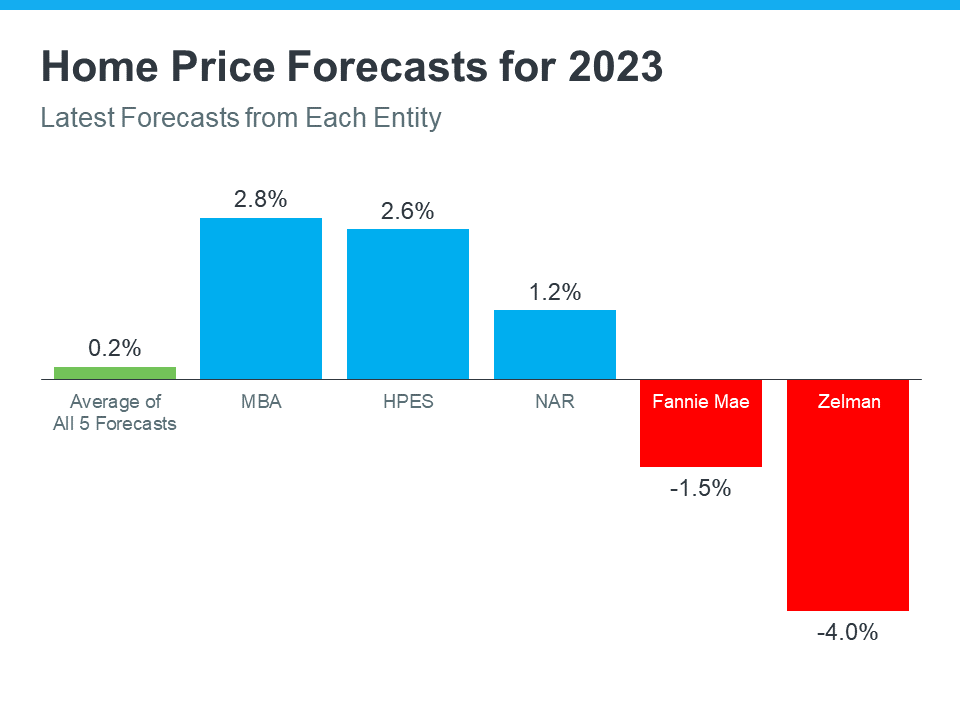

What the Experts Are Saying About Home Prices Next Year

The graph below shows the most up-to-date forecasts from five experts in the housing industry. These are the experts that have most recently updated their projections based on current market trends:

As the graph shows, the three blue bars represent experts calling for ongoing home price appreciation, just at a more moderate rate than recent years. The red bars on the graph are experts calling for home price depreciation.

While there isn’t a clear consensus, if you take the average (shown in green) of all five of these forecasts, the most likely outcome is, nationally, home price appreciation will be fairly flat next year.

What Does This Mean?

Basically, experts are divided on what’s ahead for 2023. Home prices will likely depreciate slightly in some markets and will continue to gain ground in others. It all depends on the conditions in your local market, like how overheated that market was in recent years, current inventory levels, buyer demand, and more.

The good news is home prices are expected to return to more normal levels of appreciation rather quickly. The latest forecast from Wells Fargo shows that, while they feel prices will fall in 2023, they think prices will recover and net positive in 2024. That forecast calls for 3.1% appreciation in 2024, which is a number much more in line with the long-term average of 4% annual appreciation.

And the Home Price Expectation Survey (HPES) from Pulsenomics, a poll of over one hundred industry experts, also calls for ongoing appreciation of roughly 2.6 to 4% from 2024-2026. This goes to show, even if prices decline slightly next year, it’s not expected to be a lasting trend.

As Jason Lewris, Co-Founder and Chief Data Officer for Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

Don’t let fear or uncertainty change your plans. If you’re unsure about where prices are headed or how to make sense of what’s going on in today’s housing market, reach out to a local real estate professional for the guidance you need each step of the way.

Bottom Line

The housing market is shifting, and it’s a confusing place right now. Let’s connect so you have a trusted real estate professional to help you make confident and informed decisions about what’s happening in our market.

Buyers Are Regaining Some of Their Negotiation Power in Today’s Housing Market

If you’re thinking about buying a home today, there’s welcome news. Even though it’s still a sellers’ market, it’s a more moderate sellers’ market than last year. And the days of feeling like you may need to waive contingencies or pay drastically over asking price to get your offer considered may be coming to a close.

Today, you should have less competition and more negotiating power as a buyer. That’s because the intensity of buyer demand and bidding wars is easing this year. So, if bidding wars were the biggest factor that had you sitting on the sidelines, here are two trends that may be just what you need to re-enter the market.

1. The Return of Contingencies

Over the last two years, more buyers were willing to skip important steps in the homebuying process, like the appraisal or inspection, to try to win a bidding war. But now, fewer people are waiving the inspection and appraisal.

The latest data from the National Association of Realtors (NAR) shows the percentage of buyers waiving their home inspection and appraisal is declining. And a recent survey from realtor.com confirms more sellers are accepting offers that include these conditions today. According to their August study:

- 95% of sellers reported buyers requested a home inspection

- 67% of sellers negotiated with buyers on repairs as a result of the inspection findings

This goes to show buyers are more able to include these conditions in their offers today and negotiate as needed based on the outcome of the inspection.

2. Sellers Are More Willing To Help with Closing Costs

Generally, closing costs range between 2% and 5% of the purchase price for the home. Before the pandemic, it was a common negotiation tactic for sellers to cover some of the buyer’s closing costs to sweeten the deal. This didn’t happen as much during the peak buyer frenzy over the past two years.

Today, as the market shifts and demand slows, data from realtor.com suggests this is making a comeback. A recent article shows 32% of sellers paid some or all of their buyer’s closing costs. This may be a negotiation tool you’ll see as you go to purchase a home. Just keep in mind, limits on closing cost credits are set by your lender and can vary by state and loan type. Work closely with your loan advisor to understand how much a seller can contribute to closing costs in your area.

Bottom Line

Regardless of the extremely competitive housing market of the past several years, today’s data suggests negotiations are starting to come back on the table. This is good news if you’re planning to enter the housing market. To find out how the market is shifting in our area, let’s connect.