DATE: Wednesday, August 24th, 2022 TIME: 3:45 PM PST STATES: OREGON & WASHINGTON CHANGE THIS WEEK: WORSE (since last…

Vantage Mortgage Weekly Interest Rate Tracker – 05/11/2022

Vantage Mortgage Weekly Interest Rate Tracker

DATE: Wednesday, May 11th, 2022

TIME: 1:10 PM PST

STATES: OREGON & WASHINGTON

CHANGE THIS WEEK: SLIGHTLY WORSE (since last Wednesday with daily volatility)

SUGGESTION: We suggest locking based off inflationary pressures and trends. If floating keep close eye on the market with VMG Broker and be in position to lock should you be in contract or show benefit.

MONTHLY PAYMENTS: This reflects Principal and Interest (P&I) on Conventional and also including PMI on FHA. Taxes and insurance not included, but need to be factored in housing payments and budget as these can vary by property. A VMG Mortgage Broker can run an analysis anytime by request.

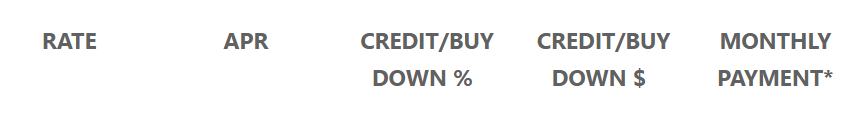

Fixed Rate Pricing Options*

(rates subject to change)

To apply to any 3rd party closing costs or prepaids

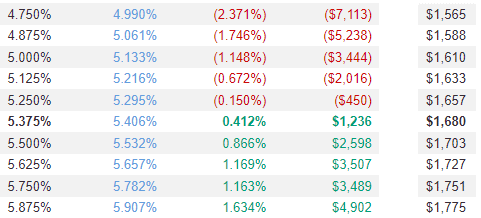

Conforming 30 Year Fixed

*Monthly Payment amount below does not include taxes & insurance.

Conforming 15 Year Fixed

*Monthly Payment amount below does not include taxes & insurance.

FHA/VA 30 YEAR FIXED

*Monthly Payment amount below does not include taxes & insurance.

*Rates change daily. Conforming conventional interest rate samples based off $375,000 purchase price, $300,000 loan amount, 80% Loan to Value, 740 or higher FICO score, with impounds on a 30 day rate lock period and $995 underwriting fee if not covered by lender rebates. FHA based off $375,000 purchase price, 3.5% down payment, but other same variables. Costs or credits shown pertain to interest rate and do not include any other applicable 3rd party title and escrow charges or prepaid tax and insurance reserves which may or may not apply. Lock period suggested depends on current loan volume and lending climate at time of loan application and approval. Other risk-based pricing adjustment may apply. The displayed annual percentage rates (APRs) include total points and additional prepaid finance charges but do not include other closing costs. On adjustable-rate loans, rates are subject to increase over the life of the loan. Learn more about assumptions and APR Information. Loan pricing may only be locked through a home loan consultant to be effective. Rates will depend in part on your unique credit history and transaction characteristics. Please email or call for updated pricing at any time as rates and pricing are subject to change. Monthly payments include principal, interest, and PMI if applicable, but not taxes and insurance. This information does not constitute a loan commitment or approval.