Spring 2022 Newsletter

Inflation & Mortgage Rates

What a start to 2022! After the pandemic ‘unicorn’ low mortgage rates of 2020 and 2021, we’ve seen a very fast and massive change in mortgage rates because of excessive inflation. Since January, mortgage rates have increased by over 2% at the fastest rate since the 1980s, and presently mortgage rates highest since 2009. For those that bought or refinanced in 2020-2021, we expect the life of these loans to be longer than they have been (historically) as we don’t expect to see mortgage rates that low again (or very unlikely). Some may still benefit from cash-out refinances for debt consolidation, PMI removal, shortening the term, etc.

We are entering a period of inflation simply because the prices of goods and services are continuing to rise. When people notice these prices rise faster than they see their wages grow, you know we’re in a period of inflation. This increase in prices impacts everything, including mortgage rates. With the dollar being devalued and reduced demand from investors in mortgage-backed bonds, rates rise for all mortgage types.

Obviously, this directly impacts monthly mortgage payments and affordability for those seeking to buy a new home in 2022. Depending on what the Federal Reserve does this year and future economic factors, time will tell where mortgage rates are headed.

We continue to embrace wholesale lender competition to ensure whatever mortgage rate climate we face we secure the most favorable terms for VMB clients.

Residential Real Estate Update

As we’ve moved past the pandemic and entered 2022, the housing market in the Pacific NW continues to favor sellers. Even with inflation pushing up rates over 2% since January, low inventory continues to press buyer demand. I do believe (ever so slightly) that we will see some reprieve for buyers as we enter the summer season with growing inventory and the ability for contingent offers to stop being vilified which is impacting many of the inventory issues and situations we see.

Remember, this is not like the 2008 housing bubble/collapse. Those buying today are well qualified for financing, deeply vetted, and have more skin in the game. Risky subprime loan programs don’t exist, but there are some new programs entering the market we’re closely monitoring. The big difference today is down payment, credit scores, and qualifying ability. Certainly this 20% or so growth YOY is not sustainable, and we’ll see some slowing in the coming months/years. Still a great time to buy real estate when compared to renting and other economic factors.

Oregon Real Estate Market

The typical home value of homes in Oregon is $509,539. This value is seasonally adjusted and only includes the middle price tier of homes. Oregon home values have gone up 19.7% over the past year.

Washington Real Estate Market

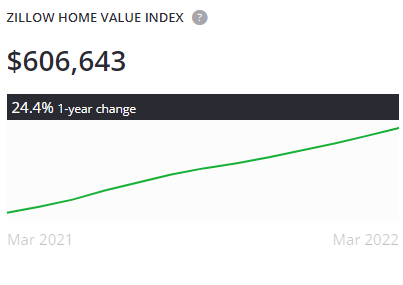

The typical home value of homes in Washington is $606,643. This value is seasonally adjusted and only includes the middle price tier of homes. Washington home values have gone up 24.4% over the past year.

Do you know anyone Buying or Refinancing?

As you may know, we work primarily by referral and consumer-direct due to our pricing advantage and local team of some of the top experts in the country. We are very grateful and thankful for your continued support and referrals and for supporting us as a fiduciary and true independent Mortgage Broker. As a result, we’ve also become the highest-reviewed independent firm in the Northwest.

We are proud to say we have ‘rebranded’ to emphasize our position as Vantage Mortgage ‘Brokers’. We want everyone to be clear that with our brand they will get transparent and TRUE wholesale lender competition. There is no more important time than now to make sure consumers shop for lower rates and fees, while also embracing the fastest and more reliable local execution and team. Only lender competition offers this and only about 10-15% in the Northwest have access to this competition via the wholesale lending channel.

Please share our information with any that would benefit and they can also check out our new pricing engine to get a second opinion or always call for a full custom quote, questions, and analysis.