By Andy Harris, President of Vantage Mortgage Brokers

Vantage Winter 2025 Newsletter

HAPPY NEW YEAR!

We wish you and your family had a great end to 2024 and a great start to the New Year. Each year is a time to reflect, and we greatly appreciate your support of our local small business in the Pacific Northwest over the last 18 years. As many know, the last few years have been pretty historically challenging for the mortgage and real estate community, so we want to share our most profound thanks, as we could not do what we do without your referrals and support.

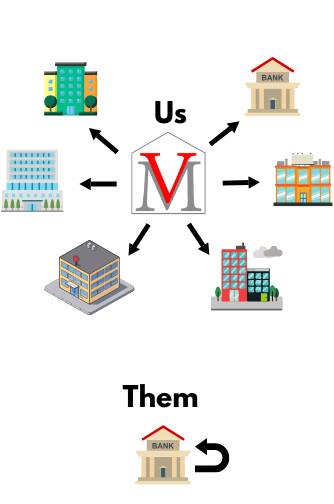

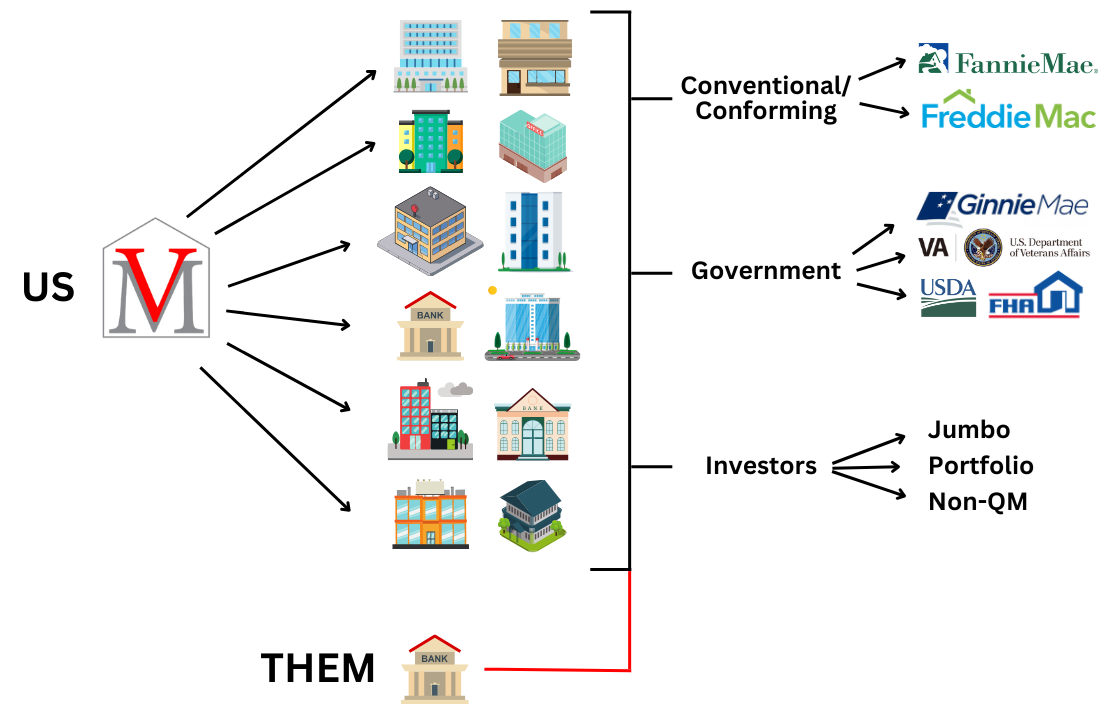

We are also excited about a recent update to our branding and website, which continues to educate and drive what we do for all Oregon, Washington, and Idaho consumers. Compete. Compare. Close. It’s always essential today to embrace lender competition and choice to reduce costs, rates, and payments. We will always prioritize our clients versus corporate special interests or steering any lender or organization. This fiduciary stance also requires us to retain one of the most experienced independent teams in the country, and we are again thankful for that and all of your support as past clients and business partners.

Please contact us with any questions and share our information with anyone in the market for a new mortgage.

COMPETITION = CONFIDENT

MORE CHOICES = LESS $

LESS CHOICES = MORE $

CAPTIVE = CONFLICT

WHEN IS IT TIME TO REFINANCE?

For anyone who purchased their homes since about mid-2022, we understand you’re watching the mortgage rate market for the right time to refinance. We believe the opportunity may come soon, and we’ll update everyone as soon as possible. You can see from the mortgage rate trends below over the last 6 months that an opportunity for some in September/October of 2024 came and went pretty quickly.

We have some benefit and recapture loan comparison worksheets that we can provide without needing a complete application to confirm any interest rate reduction market benefits. Please reach out to us with those questions to see if there are any benefits, but you can see that inflation has been stubborn, and rates have been on the rise since this lower point of 2024. We do hope that even more significant savings and opportunities come, and we will ensure you get the maximum benefits through analysis and lender comparison.

If you have questions about a cash-out refinance for debt consolidation, home improvements, etc., please reach out. We can run the same analysis to compare a first mortgage refinance versus a home equity loan or HELOC. It’s all about the blended rate and benefits.

Please share our information with anyone considering a refinance when the time is right.

We will always follow transparency and best practices at VMB:

- We embrace lender competition and shop our network of wholesale lending partners to ensure you receive accurate data and benefits without surprises later.

- We produce the rate sheet and all options for a detailed recapture analysis and understanding of the options now or in the future.

- We provide all costs or credits up front. We advise locking at application, as that makes the refinance to see terms that will not vary. We also provide the option to finance costs or not, with pros and cons.

- We embrace analytical accuracy on 3rd party closing costs and prepaids.

- We are confident in our ability to offer the most competitive options, but in the rare case we do not, we will tell you and confirm the best course of action.

Again, don’t hesitate to contact your VMB Broker for a quick update or to keep track of our custom loan comparison, benefits worksheet, and rate sheets.

TIME IN THE MARKET BEATS TIMING THE MARKET

Trying to decide whether it makes more sense to buy a home now or wait? There’s a lot to consider, from what’s happening in the market to your changing needs. But generally speaking, aiming to time the market isn’t a good strategy – there are too many factors at play for that to even be possible.

That’s why experts usually say time in the market is better than timing the market.

In other words, if you want to buy a home and you’re able to make the numbers work, doing it sooner rather than later is usually worth it. Bankrate explains why:

“No matter which way the real estate market is leaning, though, buying now means you can start building equity immediately.”

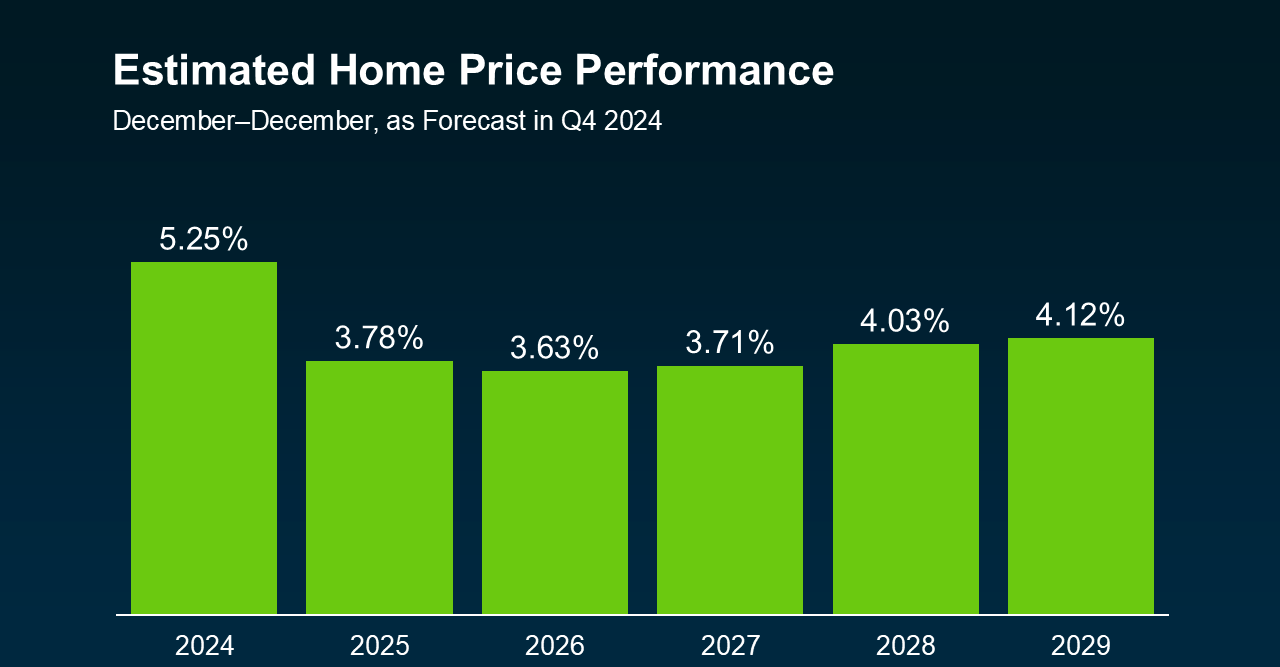

Here’s some data to break this down so you can really see the benefit of buying now versus later – if you’re able to. Each quarter, Fannie Mae releases the Home Price Expectations Survey. It asks over one hundred economists, real estate experts, and investment and market strategists what they forecast for home prices over the next five years. In the latest release, experts are projecting home prices will continue to rise through at least 2029 – just at a slower, more normal pace than they did over the past few years

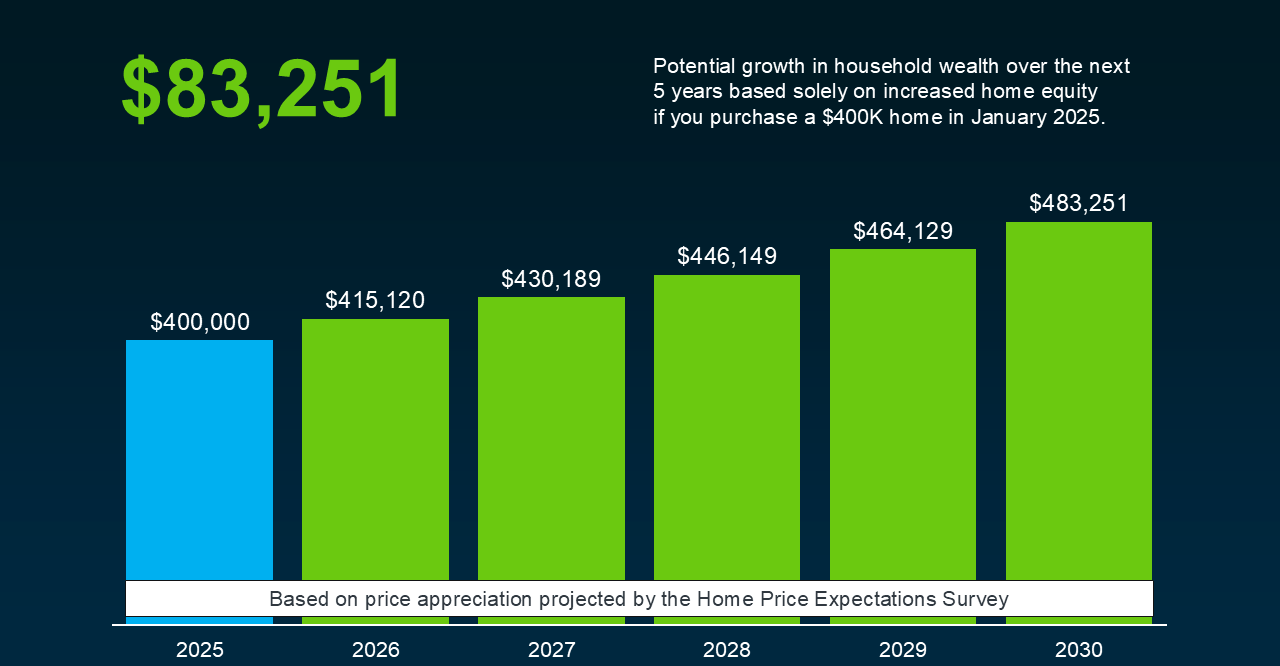

But what does that really mean for you? To give these numbers context, the graph below uses a typical home value to show how it could appreciate over the next few years using those HPES projections (see graph). This is what you could start to earn in equity if you buy a home in early 2025.

In this example, let’s say you go ahead and buy a $400,000 home this January. Based on the expert forecasts from the HPES, you could gain more than $83,000 in household wealth over the next five years. That’s not a small number. If you keep on renting, you’re losing out on this equity gain.

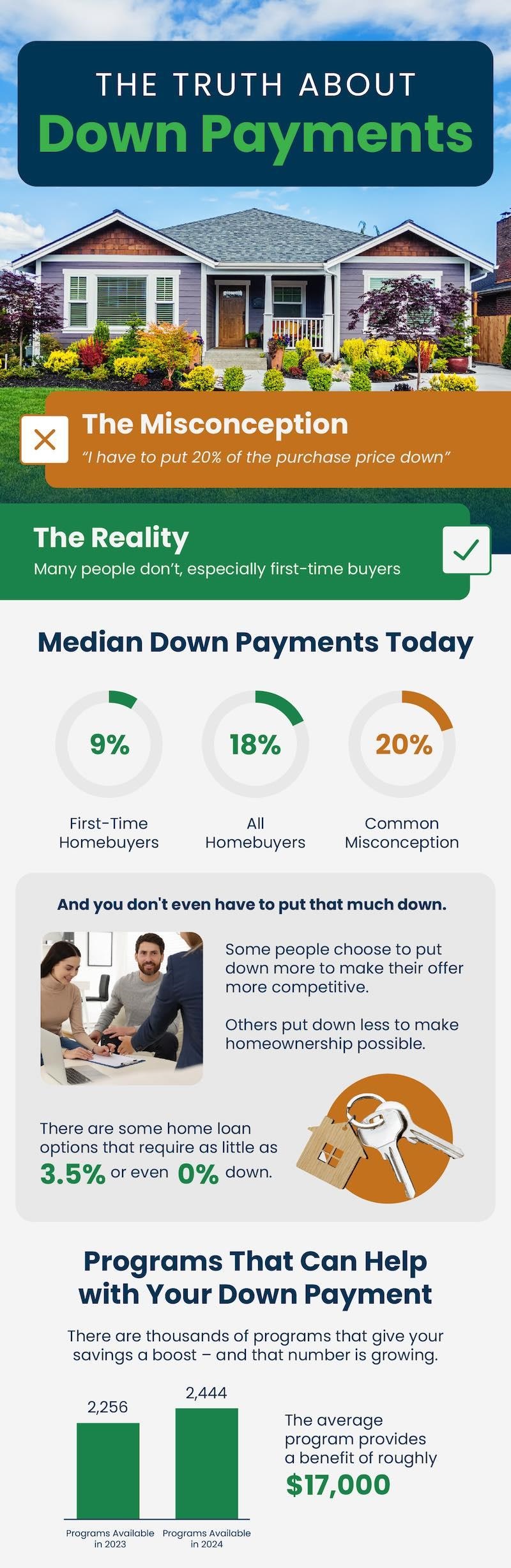

And while today’s market has its fair share of challenges, this is why buying is going to be worth it in the long run. If you want to buy a home, don’t give up. There are creative ways we can make your purchase possible. From looking at more affordable areas, to considering condos or townhomes, or even checking out down payment assistance programs, there are options to help you make it happen.

So sure, you could wait. But if you’re just waiting it out to perfectly time the market, this is what you’re missing out on. And that decision is up to you.

Bottom Line

If you’re torn between buying now or waiting, don’t forget that it’s time in the market, not timing the market that truly matters. Connect with your Mortgage Loan Consultant if you want to talk about what you need to do to get the process started today.

OREGON HOUSING MARKET OVERVIEW

Median Sale Price:

$502,900

+2.4% year-over-year

# of Homes Sold:

3,708

+19.3% year-over-year

Median Days on Market:

44

+6 year-over-year

In November 2024, home prices in Oregon were up 2.4% compared to last year, selling for a median price of $502,900. On average, the number of homes sold was up 19.3% year over year and there were 3,708 homes sold in November this year, up 3,109 homes sold in November last year. The median days on the market was 44 days, up 6 year over year.

WASHINGTON HOUSING MARKET OVERVIEW

Median Sale Price:

$637,500

+5.3% year-over-year

# of Homes Sold:

6,688

+17.5% year-over-year

Median Days on Market:

31

+5 year-over-year

In November 2024, home prices in Washington were up 5.3% compared to last year, selling for a median price of $637,500. On average, the number of homes sold was up 17.5% year over year and there were 6,688 homes sold in November this year, up 5,695 homes sold in November last year. The median days on the market was 31 days, up 5 year over year.

IDAHO HOUSING MARKET OVERVIEW

Median Sale Price:

$468,100

-2.5% year-over-year

# of Homes Sold:

2,213

+20.5% year-over-year

Median Days on Market:

56

+9 year-over-year

In November 2024, home prices in Idaho were down 2.5% compared to last year, selling for a median price of $468,100. On average, the number of homes sold was up 20.5% year over year and there were 2,213 homes sold in November this year, up 1,836 homes sold in November last year. The median days on the market was 56 days, up 9 year over year.

WE APPRECIATE YOUR BUSINESS!

Thank you so much for referring your friends, family, and co-workers to us when you hear they are in the market to buy a home or refinance. We greatly appreciate it and rely on these referrals to best serve all in the Pacific NW.

To reiterate from the last newsletter, we greatly appreciate the support of our clients and business partners referring anyone to us who may be active in this market. Mortgage lenders are not created equal and competition is vital. As a fiduciary shopping the top wholesale lenders in the country on the same identical agency loans, the value in a market like today is priceless. Interest rates and the math associated with amortization schedules and monthly repayment amounts are vital today. Again, thank you for the continued support of our long-time local team of experts and price leaders.

Reach out to a VMB team member for any questions on rate trends or scenarios.