By Andy Harris, President of Vantage Mortgage Brokers

Vantage Mortgage Brokers Summer 2024 Newsletter

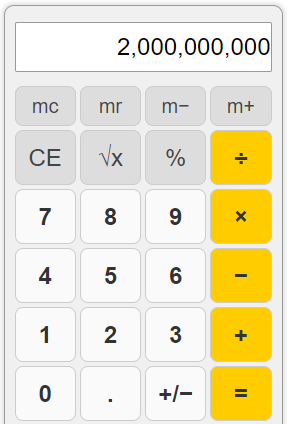

2 Billion In Loan Production!

Vantage Mortgage Brokers hit a new milestone this month, reaching $2 Billion in loan production and helping nearly 6,000 local families in the Pacific NW. As a small team, we are very proud of this accomplishment by our deeply seasoned team of experts, along with our technology and unmatched system in mortgage loan origination today.

We are very thankful to all of our past, present, and future clients and business partners for their support. We will continue to transform how consumers access mortgages through transparency and lender competition.

Thank you all so much, and please reach out to us if we can assist you or anyone you know in Oregon, Washington, and Idaho.

Mortgage Rate Update

Vantage Mortgage Brokers has been tracking mortgage rates weekly for over a decade on our weekly rate tracker. Every Wednesday, we publish mortgage rate trends week-over-week. You can access our weekly rate tracker below if you are monitoring interest rates, and we will continually update everyone on opportunities when they arise.

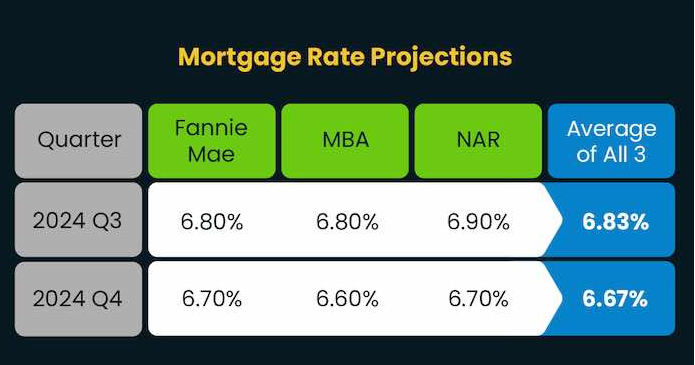

There is anticipation that the Federal Reserve will finally start cutting interest rates in September, but time will tell. If continued economic data shows that inflation is slowing and dropping, interest rates will follow that trend. There will be a lot of economic indicators later this year and into next year, including inflation, the election, the economy around recessionary discussions, jobs, etc.

Median Sale Price

$523,000

+2.2% year-over-year

# of Homes Sold

4,587

+5.9% year-over-year

Median Days on Market

22

0 year-over-year

In May 2024, home prices in Oregon were up 2.2% compared to last year, selling for a median price of $523,000. On average, the number of homes sold was up 5.9% year over year and there were 4,587 homes sold in May this year, up 4,333 homes sold in May last year. The median days on the market was 22 days.

Median Sale Price

$657,700

+6.4% year-over-year

# of Homes Sold

8,667

+5.7% year-over-year

Median Days on Market

13

+1 year-over-year

In May 2024, home prices in Washington were up 6.4% compared to last year, selling for a median price of $657,700. On average, the number of homes sold was up 5.7% year over year and there were 8,667 homes sold in May this year, up 8,204 homes sold in May last year. The median days on the market was 13 days, up 1 year over year.

Median Sale Price

$488,100

+4.3% year-over-year

# of Homes Sold

2,539

+7.0% year-over-year

Median Days on Market

32

-3 year-over-year

In May 2024, home prices in Idaho were up 4.3% compared to last year, selling for a median price of $488,100. On average, the number of homes sold was up 7.0% year over year and there were 2,539 homes sold in May this year, up 2,363 homes sold in May last year. The median days on the market was 32 days, down 3 year over year.

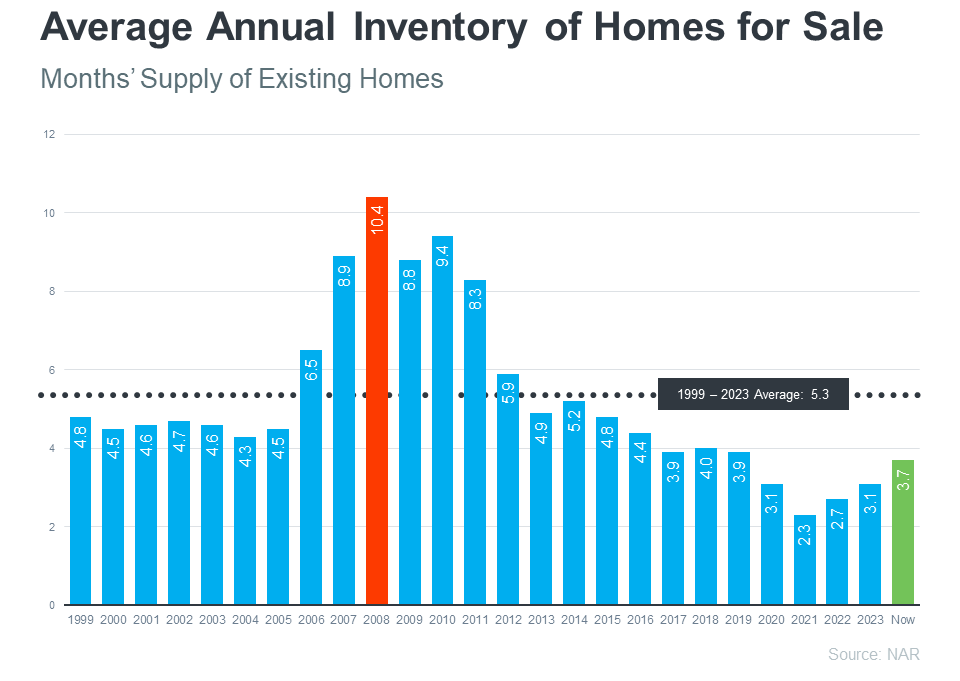

Not A Crash: How Today's Home Inventory Differs From 2008

Though many Americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

Here’s why experts are so confident. For the market (and home prices) to crash, there would have to be too many houses for sale, but the data doesn’t show that’s happening. Right now, there’s an undersupply, not an oversupply like the last time – and that’s true even with the inventory growth we’ve seen this year.

Although the supply of existing (previously owned) homes is up compared to this time last year, it’s still low overall. And while this varies by local market, nationally, the current months’ supply is well below the norm, and even further below what we saw during the crash. The graph below shows this more clearly.

If you look at the latest data (shown in green), compared to 2008 (shown in red), we only have about a third of that available inventory today.

So, what does this mean? There just aren’t enough homes available to make values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that’s not the case right now.

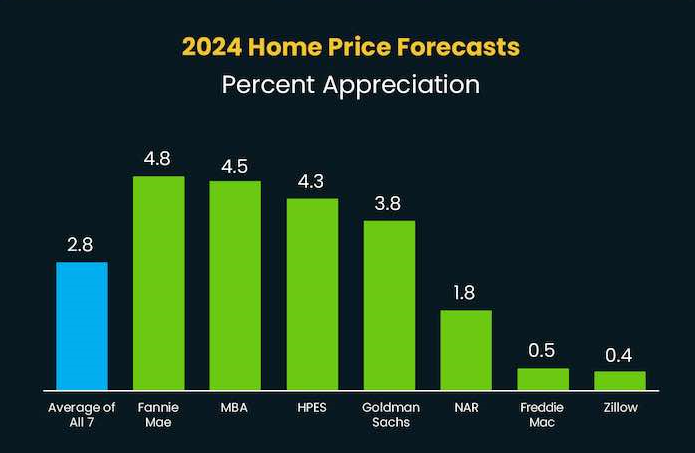

Housing Market Forecast For The 2nd Half Of 2024

Wondering what the second half of the year holds for the housing market? Here’s what expert forecasts say:

Home prices will keep rising, just at a more normal pace.

That means you won’t have to deal with prices skyrocketing when you buy, and your home should grow in value once you do.

As inflation continues to cool, mortgage rates should ease. This will help with affordability, especially as price growth moderates too.

The number of home sales should be about the same as last year.

To sum it up:

- Home prices are expected to climb moderately

- Mortgage rates are forecast to come down slightly

- Home sales are projected to hold steady

We Appreciate Your Business

Thank you so much for referring your friends, family, and co-workers to us when you hear they are in the market to buy a home or refinance. We greatly appreciate it and rely on these referrals to best serve all in the Pacific NW.

To reiterate from the last newsletter, we greatly appreciate the support of our clients and business partners referring anyone to us who may be active in this market. Mortgage lenders are not created equal and competition is vital. As a fiduciary shopping the top wholesale lenders in the country on the same identical agency loans, the value in a market like today is priceless. Interest rates and the math associated with amortization schedules and monthly repayment amounts are vital today. Again, thank you for the continued support of our long-time local team of experts and price leaders.

Reach out to a VMB team member for any questions on rate trends or scenarios.