Vantage Mortgage Brokers Spring 2024 Newsletter

Mortgage Rates and Inflation (The Ongoing Saga)

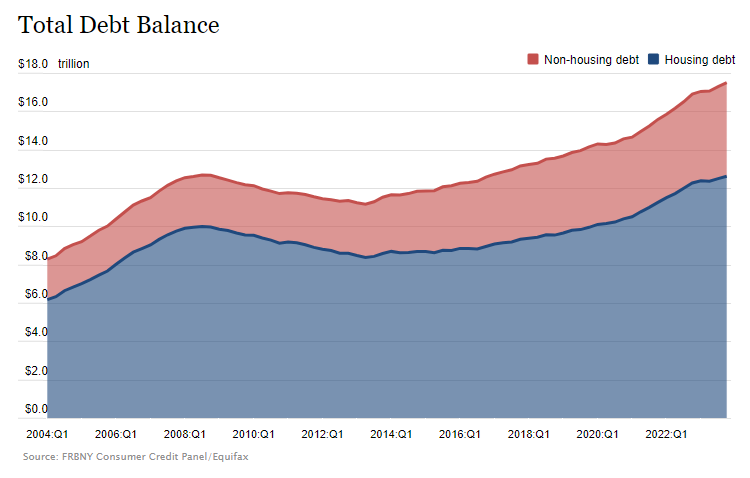

It’s no surprise. Everyone is feeling inflation. Total household debt rose by $212 Billion to reach $17.5 trillion in the fourth quarter of 2023. That one takes a bit to sink in. What’s worse is that interest rates are up and will stay up until the Federal Reserve feels they have enough evidence to cut rates with inflation slowing. Credit card balances increased by $50 Billion to $1.13 Trillion during this same quarter, according to the latest Quarterly Report on Household Debt and Credit. Delinquency transition rates increased for all debt types except for student loans.

The Fed will meet again mid-year to determine if a cut is warranted or if they will kick the can down the road with inflation still looming. We certainly know that housing affordability has been a major issue that is also impacting inventory. We continue to work through strategies to reach more buyers and help to avoid any captive options or rates but we certainly could use some mortgage rate love. We hope that our country can work together to fix our deficit at a macro level and family budgets can also work to reduce debt at the micro level. A drop in inflation would certainly help with that burden.

United Wholesale Mortgage (UWM)

As you know, Vantage Mortgage Brokers offers a platform for consumers in the Pacific Northwest to embrace lender competition and transparent mortgage options as a fiduciary. Part of that process is to analyze rate sheets in a universal pricing engine, shop out the most favorable terms (with about 30-40 wholesale lenders on average), and use analysis in recapture data, etc., when showing several rates to choose from among these top investors. Our leadership has been nationally involved and very vocal in this space for nearly two decades, advocating for consumers, small businesses, and compliance in operating with integrity in the independent space.

Since 2007, we have seen many wholesale lenders come and go. We merely consider them ‘logos’ to the agencies and investors that truly back these residential mortgage loans in the United States for conventional and government loans (Fannie Mae, Freddie Mac, Ginnie Mae, etc.). Competition is vital and the core of what we do between lenders. We expect and carry only the best partners who execute, communicate, and service these loans with zero exceptions, or we terminate them as a Vantage partner otherwise. As a result of optionality and mortgage rates that change often, we also have a broad percentage of volume spread across multiple investors at all times (in some markets, if one consistently carries the best rates, they may see slightly more volume temporarily). As a reminder, our company may NOT earn any higher lender-paid origination fee % as agreed with partners by using one lender over another. Any incentives or pricing improvements must go to our clients by federal compensation laws. This is not true for other origination channels, so we only support wholesale lending.

In prior years, we were partnered with a company named United Wholesale Mortgage. In the past, this company performed and priced favorably as a choice for our clients; some of you experienced that. As things have progressed in recent years, we noticed a deterioration in the quality of pricing and some significant concerns with the additional information we were tracking in their operational behavior. This progression did not align with our ethics, and the pricing did not meet our expectations, so we terminated our broker agreement with United Wholesale Mortgage in February 2022.

In the coming days or weeks, you might see a story in the news about a class action lawsuit filed against United Wholesale Mortgage (if not already) by consumers who feel that they were misled or steered into higher-cost mortgages. This lawsuit ‘claims’ they (UWM) created a scheme to motivate originators (who claimed to be brokers or independent for the consumers they were serving) to steer their business to United Wholesale Mortgage (some upwards of 99% of their volume). This will be an ongoing matter, and while innocent until proven guilty, we strongly do not condone this behavior and have always spoken against it, as lender influence is unacceptable in the wholesale lending channel. Loyalty here is only to the consumers we serve and never to a lender. If UWM currently services your loan, your data and information are safe and unrelated to the origination and underwriting of a new loan file. Please be sure to call or email us immediately if you are contacted or solicited by UWM or any associated company.

Median Sale Price

$488,500

+1.1% year-over-year

# of Homes Sold

2,940

-3.3% year-over-year

Median Days on Market

56

+2 year-over-year

In February 2024, home prices in Oregon were up 1.1% compared to last year, selling for a median price of $488,500. On average, the number of homes sold was down 3.3% year over year and there were 2,940 homes sold in February this year, down 3,040 homes sold in February last year. The median days on the market was 56 days, up 2 year over year.

Median Sale Price

$617,600

+8.3% year-over-year

# of Homes Sold

5,468

-0.2% year-over-year

Median Days on Market

31

-14 year-over-year

In February 2024, home prices in Washington were up 8.3% compared to last year, selling for a median price of $617,600. On average, the number of homes sold was down 0.2% year over year and there were 5,468 homes sold in February this year, down 5,482 homes sold in February last year. The median days on the market was 31 days, down 14 year over year.

Median Sale Price

$483,500

+6.9% year-over-year

# of Homes Sold

1,721

-5.5% year-over-year

Median Days on Market

63

-29 year-over-year

In February 2024, home prices in Idaho were up 6.9% compared to last year, selling for a median price of $483,500. On average, the number of homes sold was down 5.5% year over year and there were 1,721 homes sold in February this year, down 1,819 homes sold in February last year. The median days on the market was 63 days, down 29 year over year.

The Best Week To List Your House Is Almost Here

Are you thinking about making a move? If so, now may be the perfect time to start the process. That’s because experts say the best week to list your house is just around the corner.

A recent Realtor.com study looked at housing market trends over the past several years (with the exception of 2020, since it was an unusual year), and found the best week to put your house on the market this year is April 14-20:

“Every year, one week stands out from the rest as that perfect stretch of time when it’s great to be a home seller. This year, the week of April 14–20 is the best time to sell—that is, if sellers want to see lots of interest in their homes, sell quickly, and pocket some extra cash, according to Realtor.com® data.”

Here’s why this matters for you. While the spring market is a great time to sell no matter the week, this may be the peak sweet spot. And if you’ve been putting your plans on the back burner and waiting for the right time to act, this could be the nudge you need to make your move happen. As Hannah Jones, Senior Economic Research Analyst at Realtor.com explains:

“The third week of April brings the best combination of housing market factors for sellers. The best week offers higher buyer demand, lower competition [from other sellers], and fewer price reductions than the typical week of the year.”

But, if you want to get in on the action, you’ll need to move quickly and lean on the pros. Your local real estate agent is the perfect go-to when it comes to figuring out a plan to prep your house and get it on the market.

They’ll be able to offer advice to balance your target listing date with what you need to do from a repair and renovation standpoint. And they can walk you through exactly how to prioritize your list so you know what to tackle first.

For example, if your house is already in good shape, you’ll be able to really focus in on the smaller things that are easy to do and make a big impact. As an article from Investopedia says:

“You won’t have time for any major renovations, so focus on quick repairs to address things that could deter potential buyers.”

Just remember, even if you’re not ready to list within the next couple of weeks, that’s okay. The window of opportunity doesn’t close when this week ends. Spring is the peak homebuying season and it’s still a seller’s market, so you’ll be in the driver’s seat all season long.

Bottom Line

Ready to get the ball rolling? Connect with a real estate agent to schedule a time to go over your next steps.

What Are Experts Saying About The Spring Housing Market?

If you’re planning to move soon, you might be wondering if there’ll be more homes to choose from, where prices and mortgage rates are headed, and how to navigate today’s market. If so, here’s what the professionals are saying about what’s in store for this season.

Odeta Kushi, Deputy Chief Economist, First American:

“. . . it seems our general expectation for the spring is that we will see a pickup in inventory. In fact, that already seems to be happening. But it won’t necessarily be enough to satiate demand.”

Lisa Sturtevant, Chief Economist, Bright MLS:

“There is still strong demand, as the large millennial population remains in the prime first-time homebuying range.”

Danielle Hale, Chief Economist, Realtor.com:

“Where we are right now is the best of both worlds. Price increases are slowing, which is good for buyers, and prices are still relatively high, which is good for sellers.”

Skylar Olsen, Chief Economist, Zillow:

“There are slightly more homes for sale than this time last year, and there is still plenty of competition for well-priced houses. Buyers should prep their credit scores and sellers should prep their properties now, attractive listings are going pending in less than a month, and time on market will shrink in the weeks ahead.”

Jiayi Xu, Economist, Realtor.com:

“While mortgage rates remain elevated, home shoppers who are looking to buy this spring could find more affordable homes on the market than they saw at the same time last year. Specifically, there were 20.6% more homes available for sale ranging between $200,000 and $350,000 in February 2024 than a year ago, surpassing growth in other price ranges.”

If you’re looking to sell, this spring might be your sweet spot because there just aren’t many homes on the market. Sure, inventory is rising, but it’s nowhere near enough to meet today’s buyer demand. That’s why they’re still selling so quickly.

If you’re looking to buy, the growing number of homes for sale this spring means you’ll have more choices than this time last year. But be prepared to move quickly since there’ll be plenty of competition with other buyers.

We Appreciate Your Business

Thank you so much for referring your friends, family, and co-workers to us when you hear they are in the market to buy a home or refinance. We greatly appreciate it and rely on these referrals to best serve all in the Pacific NW.

To reiterate from the last newsletter, we greatly appreciate the support of our clients and business partners referring anyone to us who may be active in this market. Mortgage lenders are not created equal and competition is vital. As a fiduciary shopping the top wholesale lenders in the country on the same identical agency loans, the value in a market like today is priceless. Interest rates and the math associated with amortization schedules and monthly repayment amounts are vital today. Again, thank you for the continued support of our long-time local team of experts and price leaders.

Reach out to a VMB team member for any questions on rate trends or scenarios.