Vantage Fall 2024 Newsletter

IS IT TIME TO REFINANCE?

As a team, we’ve been closely tracking rates for all those who purchased a home from mid-2022 and beyond while rates were inflated and now slowly coming down. While the Federal Reserve doesn’t control mortgage rates directly, its initial rounds of cuts finally started in September 2024. We anticipate continued inflation pressures dropping, additional Fed cuts, and even lower mortgage rates soon.

It’s important to remember not to refinance prematurely. Please reach out to us first! Some of you may stand to gain significantly from the recent rate drop, presenting an opportunity. We’re here for you, ready to answer any questions and provide an updated benefit analysis. We’re doing our best to reach out to everyone, but the rates have been a bit volatile. With property tax season upon us, this could affect what is financed or not.

Please don’t hesitate to contact us. To produce updated numbers, we need the most recent mortgage statement and additional questions answered. For some, we’re holding for the right time and enough benefits (not premature), but we’ll confirm either way.

WARNINGS

It’s crucial to be vigilant as we are sadly seeing some of the most significant violations of consumer protection laws and ethics in the mortgage industry. This is due to the lack of enforcement and desperation from the sector after these difficult years through inflation and higher rates. Below are a few to look out for.

It’s essential to remember that your loan servicer or current lender doesn’t own your loan. They only service the loan, and if they solicit, be very careful. Our investor servicers are not supposed to do this due to these conflicts. Some of the worst violations come from these servicers being dishonest about discounts that don’t apply or others that buy ‘trigger’ leads.

‘No Cost’ Refinance. The truth is, there’s always a cost- it’s just hidden in a higher interest rate. In every transaction, there are thousands of 3rd party required services (title/escrow), along with prorated and updated prepaid taxes and insurance, that apply. ‘No out-of-pocket’ doesn’t mean ‘no cost ‘. A lender can’t skip these requirements without increasing the interest rate and using margin to cover these costs. The key is that you must be presented with all options and choose by comparing all interest rates that will produce a discount cost at lower rates or higher lender rates and credits. You also decide what you wish to finance or not finance.

Equity Stripping. We often see this for conventional borrowers and VA/FHA streamline refinances. Loan originators or lenders will steer and over-sell a rate and benefit savings when the savings are minor. This then strips thousands in home equity through financing higher costs in a more significant loan amount with a recapture period that is much too long. This is motivated by the lender’s margin and the loan originator’s commission, but not considering your mathematical benefits at all ethically.

Bait and Switch. We have seen a significant increase in loan officers and lenders verbally lying to consumers and telling them they are getting discounts or no-cost loans. Later, formal disclosures with thousands of dollars in previously hidden financed costs were provided. Some are even tens of thousands at rates that are not competitive. In addition, many are issuing Loan Estimates with the floating rates and any quoted fees. Since they are not bound to these terms, they wait until the loan is nearly final to ‘lock’ in a rate and substantially higher costs, claiming the market moved when that is a lie.

“Free” Refinance again if rates drop later. The above details show that this doesn’t exist. It is a lie to manipulate business today, and it’s unacceptable. Please don’t fall for these fraudsters steering higher-cost loans and presenting them as a discount now or later.

“Trigger” Leads. The most unethical loan officers and lenders buy trigger leads from credit agencies. If you have your credit pulled for a mortgage, your privacy is significantly impacted by these unscrupulous people calling, texting, and emailing you. There are opt-out measures in place we send everyone, but lying about having your financial data or application when they do not is beyond problematic. There are bills in Congress to make these practices illegal finally in 2025 (the goal).

We will always follow transparency and best practices at VMB:

- We embrace lender competition and shop our network of wholesale lending partners to ensure you receive accurate data and benefits without surprises later.

- We produce the rate sheet and all options for a detailed recapture analysis and understanding of the options now or in the future.

- We provide all costs or credits up front. We advise locking at application, as that makes the refinance to see terms that will not vary. We also provide the option to finance costs or not, with pros and cons.

- We embrace analytical accuracy on 3rd party closing costs and prepaids.

- We are confident in our ability to offer the most competitive options, but in the rare case we do not, we will tell you and confirm the best course of action.

Again, don’t hesitate to contact your VMB Broker for a quick update or to keep track of our custom loan comparison, benefits worksheet, and rate sheets.

OREGON HOUSING MARKET OVERVIEW

Median Sale Price:

$512,500

+0.8% year-over-year

# of Homes Sold:

4,524

-6.5% year-over-year

Median Days on Market:

33

+7 year-over-year

In August 2024, home prices in Oregon were up 0.8% compared to last year, selling for a median price of $512,500. On average, the number of homes sold was down 6.5% year over year and there were 4,524 homes sold in August this year, down 4,839 homes sold in August last year. The median days on the market was 33 days, up 7 year over year.

WASHINGTON HOUSING MARKET OVERVIEW

Median Sale Price:

$644,100

+4.9% year-over-year

# of Homes Sold:

8,404

-1.6% year-over-year

Median Days on Market:

21

+6 year-over-year

In August 2024, home prices in Washington were up 4.9% compared to last year, selling for a median price of $644,100. On average, the number of homes sold was down 1.6% year over year and there were 8,404 homes sold in August this year, down 8,542 homes sold in August last year. The median days on the market was 21 days, up 6 year over year.

IDAHO HOUSING MARKET OVERVIEW

Median Sale Price:

$481,500

+2.0% year-over-year

# of Homes Sold:

2,539

-3.6% year-over-year

Median Days on Market:

32

+7 year-over-year

In August 2024, home prices in Idaho were up 2.0% compared to last year, selling for a median price of $481,500. On average, the number of homes sold was down 3.6% year over year and there were 2,479 homes sold in August this year, down 2,568 homes sold in August last year. The median days on the market was 41 days, up 7 year over year.

THIS IS THE SWEET SPOT HOMEBUYERS HAVE BEEN WAITING FOR

After months of sitting on the sidelines, many homebuyers who were priced out by high mortgage rates and affordability challenges finally have an opportunity to make their move. With rates trending down, today’s market is a sweet spot for buyers—and it’s one that may not last long.

So, if you’ve put your own move on the back burner, here’s why maybe you shouldn’t delay your plans any longer.

As you weigh your options and decide if you should buy now or wait, ask yourself this: What do you think everyone else is going to do?

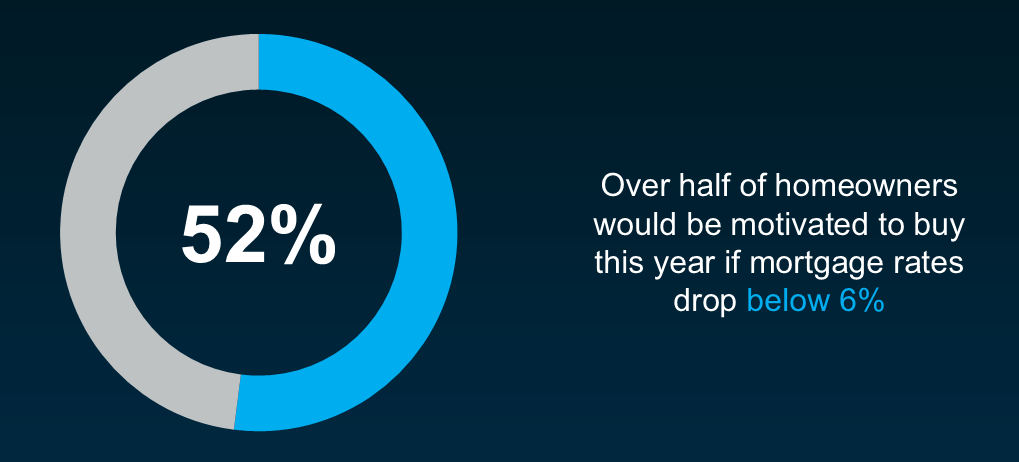

The truth is, if mortgage rates continue to ease, as experts project, more buyers will jump back into the market. A survey from Bankrate shows over half of homeowners would be motivated to buy this year if rates drop below 6% (see graph below):

With rates already in the low 6% range, we’re not terribly far off from hitting that threshold. The bottom line is, that when they drop into the 5s, the number of buyers in the market is going to go up – and that means more competition for you.

That increased demand will likely push home prices up, which could potentially take away from some of the benefits you’d gain from a slightly lower interest rate. As Nadia Evangelou, Senior Economist and Director of Real Estate Research at the National Association of Realtors (NAR), explains:

“The downside of increased demand is that it puts upward pressure on home prices as multiple buyers compete for a limited number of homes. In markets with ongoing housing shortages, this price increase can offset some of the affordability gains from lower mortgage rates.”

So, while waiting to buy may seem like a smart move, it could backfire if rising prices outpace your savings from slightly lower rates.

What This Means for You

Right now, you’ve got the chance to get ahead of all of that. Today’s market is a buyer sweet spot. Why? Because a lot of other buyers are waiting – which means not as many people are actively looking for homes. That means less competition for you.

At the same time, affordability has already improved quite a bit. Recent easing in mortgage rates has made homeownership more accessible. As Mike Simonsen, Founder of Altos Research, says:

“Mortgage payments on the typical-price home are 7% lower than last year and are 13% lower than the peak in May 2024.”

And while the supply of homes for sale is still low, it’s also higher than it’s been in years. According to Ralph McLaughlin, Senior Economist at Realtor.com:

“The number of homes actively for sale continues to be elevated compared with last year, growing by 35.8%, a 10th straight month of growth, and now sits at the highest since May 2020.”

This means you now have more options to choose from than you’ve had in quite a while.

With fewer buyers in the market, improving affordability, and more homes to choose from, you have the chance to find the right one before the competition heats up.

Why Waiting Could Cost You

If you’re waiting for the perfect time to buy, it’s important to understand that timing the market is nearly impossible. The longer you wait, the higher the risk that market conditions will shift—and not necessarily in your favor. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“It’s one of those things where you should be careful what you wish for. A further drop in mortgage rates could bring a surge of demand that makes it tougher to actually buy a house.”

Bottom Line

Don’t wait until you have to deal with more competition and higher prices – you already have the chance to buy a home while we’re in the sweet spot today.

WE APPRECIATE YOUR BUSINESS!

Thank you so much for referring your friends, family, and co-workers to us when you hear they are in the market to buy a home or refinance. We greatly appreciate it and rely on these referrals to best serve all in the Pacific NW.

To reiterate from the last newsletter, we greatly appreciate the support of our clients and business partners referring anyone to us who may be active in this market. Mortgage lenders are not created equal and competition is vital. As a fiduciary shopping the top wholesale lenders in the country on the same identical agency loans, the value in a market like today is priceless. Interest rates and the math associated with amortization schedules and monthly repayment amounts are vital today. Again, thank you for the continued support of our long-time local team of experts and price leaders.

Reach out to a VMB team member for any questions on rate trends or scenarios.