Why Choose Vantage?

OUR MISSION

Transform the way consumers get access to mortgages, with transparency and competition

Our internal pricing engine compares the top wholesale lenders in the country in real-time (example below). This customized analysis allows our independence and experience to expose the most favorable loan terms and speed. If a loan originator is employed by only one lender (as most are), they lack the competition necessary to access these benefits for their clients and must steer toward special interests.

Sample Rate Sheet*

INTEREST RATE CHOICE AND COMPARISON

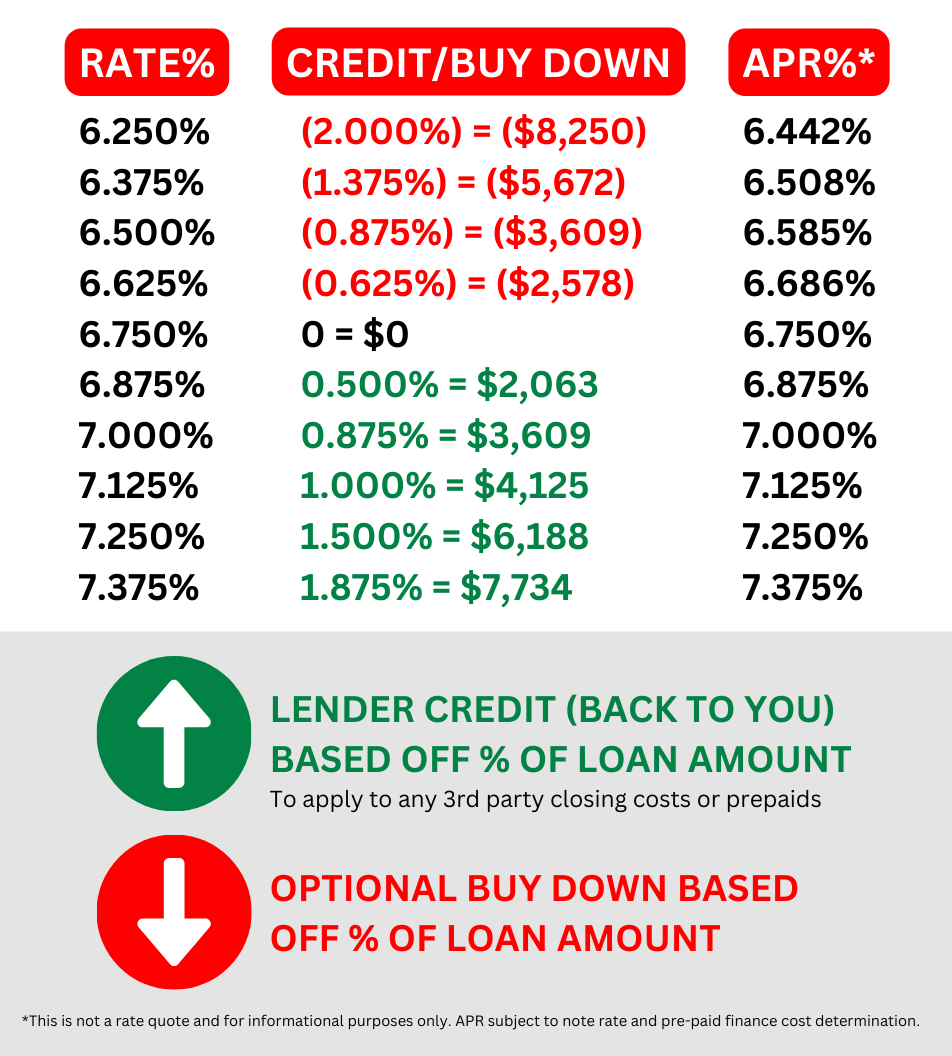

Once investor is determined, the comparison on note rate options and corresponding cost/credits are available to our clients from a no cost loan to rate buy-down and everything in-between.

Sample Rate Sheet*

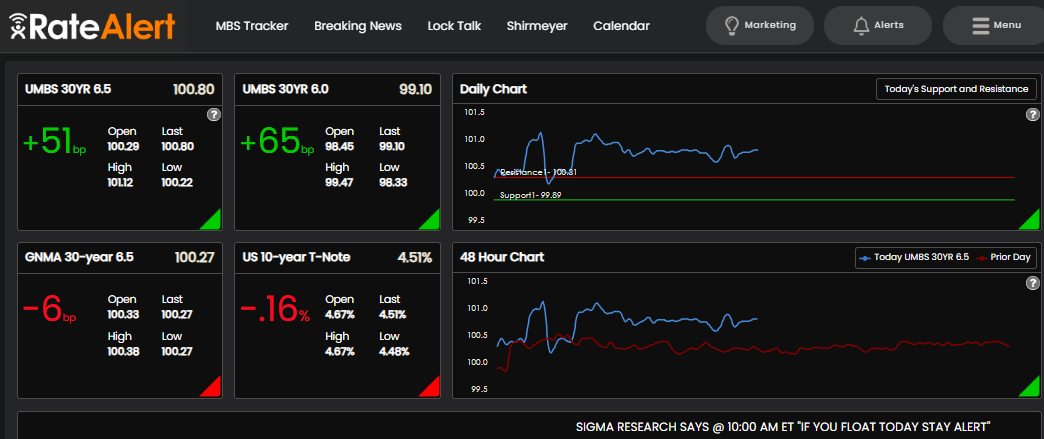

MARKET WATCH AND RATE/CREDIT UPDATES

Locking at the right time during economic uncertainty and volatility

VISION

Educate and be available to serve all mortgage consumers in our service area so lenders authentically compete for their business

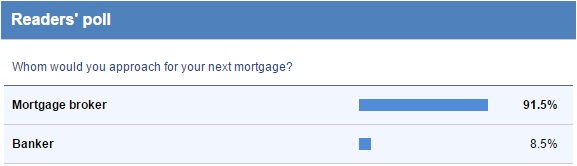

BROKER VS. BANKER

Bankrate published an article in 2015 around the topic of Mortgage Broker versus Banker and which one is better for the consumer. After hearing from both sides, readers were asked to choose which they would prefer if they were in the market to buy or refinance a home.

The reader poll results were heavily in favor of the Mortgage Broker. Over 90% of readers said they would choose a Mortgage Broker over a Mortgage Banker.

What makes this study interesting is that approximately 10% of providers in the Pacific Northwest are “True” Mortgage Brokers, leaving the other 90% Mortgage Bankers. This means that consumers must carefully research and ensure that they are talking also with a Mortgage Broker when shopping for a new mortgage and seeking pre-approval. Chances are they might be talking with a Mortgage Banker inaccurately using the broker term.

At Vantage, we are your “True” Mortgage Brokers. We support lender competition and see the industry from a macro view versus a micro view Mortgage Bankers are required to comply with inside their company. We believe the restricted view provided by the banker, such as in this article, are disconnected and false from industry fact.

We will continue to support the wholesale lending channel and ensure consumers are educated rather than being sold by lenders employees.

UNDERSTANDING THE MORTGAGE LOAN ORIGINATION CHANNELS

Residential loans (Conventional and Government) are originated in the Primary Market and sold in the Secondary Market consisting of both public and private investors who buy mortgage notes. These investors are primarily Fannie Mae, Freddie Mac and Ginnie Mae. Lenders then replenish cash reserves so they can originate more loans. The Primary Market is important to the consumer because this is where it’s created. These loans all end up in the same place and are offered by the same lenders, just through different channels.

This makes selecting the originator the most important part of the mortgage process. With recent industry changes/trends and in protection of the consumer, we support competition and choice.

ACTION

Deliver lower mortgage costs and a faster origination experience by working for YOU rather than the lenders, using a transparent and systematic approach to making lenders compete for YOUR business.

“Our main objective is to educate consumers on how residential mortgage financing works in the United States. We do not have sales people, we have mortgage professionals that persistently educate our clients. We embrace only math and facts rather than sales terms and strategies. We rely on indisputable data to attract those that wish to be in a better financial position with their mortgage liability. When it comes to math, combined with our reputation, our position is also indisputable. We are the only channel in the primary mortgage market that works exclusively for our clients. The more educated the consumer, the greater chance they will become a Vantage client when comparing mortgage providers.”

WHY CHOOSE VANTAGE?

- No special interests. We work exclusively for YOU and carry no influence from business affiliations or steering toward bank or bank line priorities (which most lenders do when their originators lack independence).

- Full disclosure. We expose any premiums received in the interest rate to apply as a credit to reduce closing costs and settlement charges.

- The ability to compare. We compare the rates, costs, and programs of the very best wholesale lenders to allow competition to produce the most favorable terms and speed.

- Service. Our heightened focus on communication and paperless processing system allows us to expedite your loan application for a smooth and more enjoyable experience.

- Pricing. Our low overhead and flexibility for choice and comparison allows us to provide very competitive pricing many feel is unmatched with our level of experience included.

- Market Watch. Our Loan Consultants have a very close grasp on the mortgage-backed securities market to provide rate lock suggestion in this volatile bond market which can save $.

- Your Loan Consultant is local, licensed under the Nationwide Mortgage Licensing System (NMLS), and complies with the Safe Act for entry-level and continuing education, including fingerprinting and background check.

- Reputation and experience. Our reputation and respect in the marketplace has been earned by our ability to exceed expectations and always do the right thing. We’re happy to be one of the highest customer-rated firms in the Pacific NW.

- “A+” rating with the BBB and several National awards for our accomplishments and integrity in the primary residential mortgage market.

- Serving our local community. Vantage Mortgage Group is owned and operated locally in the Pacific NW – supporting our neighbors and local small business.