FHA Home Loans

– Less credit restrictions

– Lower private mortgage insurance (PMI) premiums

– No cash reserves required.

OREGON 2024 FHA LOAN LIMITS

COUNTIES

SINGLE

DUPLEX

TRI-PLEX

4-PLEX

Baker, Coos, Crook, Curry, Douglas, Gilliam, Grant, Harney, Jackson, Jefferson, Josephine, Klamath, Lake, Lane, Lincoln, Linn, Malheur, Marion, Morrow, Polk, Sherman, Tillamook, Umatilla, Union, Wallowa, Wasco, Wheeler

$524,225

$671,200

$811,275

$1,008,300

Clatsop

$561,200

$718,450

$868,400

$1,079,250

Benton

$598,000

$765,550

$925,350

$1,150,000

Clackamas, Columbia, Multnomah, Washington, Yamhill

$695,750

$890,700

$1,076,650

$1,338,000

Deschutes

$713,000

$912,750

$1,103,350

$1,371,150

Hood River

$762,450

$976,100

$1,179,850

$1,466,250

WASHINGTON 2024 FHA LOAN LIMITS

COUNTIES

SINGLE

DUPLEX

TRI-PLEX

4-PLEX

Adams, Asotin, Benton, Clallam, Columbia, Cowlitz, Ferry, Franklin, Garfield, Grant, Grays Harbor, Jefferson, Kittitas, Klickitat, Lewis, Lincoln, Mason, Okanogan, Pacific, Pend Oreille, San Juan, Spokane, Stevens, Wahkiakum, Walla Walla, Yakima

$524,225

$671,200

$811,275

$1,008,300

Chelan, Douglas

$546,250

$699,300

$845,300

$1,050,500

Clark, Skamania

$695,750

$890,700

$1,076,650

$1,338,000

Island

$603,750

$772,900

$934,250

$1,161,050

King, Pierce, Snohomish

$1,037,300

$1,327,950

$1,605,200

$1,994,850

Kitsap

$575,000

$736,100

$889,800

$1,105,800

Skagit

$563,500

$721,400

$872,000

$1,083,650

Thurston

$557,750

$714,000

$863,100

$1,072,600

Whatcom

$632,500

$809,700

$978,750

$1,216,350

Whitman

$579,600

$742,000

$896,900

$1,114,650

IDAHO 2024 FHA LOAN LIMITS

COUNTIES

SINGLE

DUPLEX

TRI-PLEX

4-PLEX

Adams, Bannock, Bear Lake, Benewah, Bingham, Bonner, Bonneville, Boundary, Butte, Caribou, Cassia, Clark, Clearwater, Custer, Elmore, Franklin, Fremont, Gooding, Idaho, Jefferson, Jerome, Latah, Lemhi, Lewis, Lincoln, Madison, Minidoka, Nez Perce, Oneida, Payette, Power, Shoshone, Twin Falls, Washington

$524,225

$671,200

$811,275

$1,008,300

Kootenai

$572,700

$733,150

$886,200

$1,101,350

Valley

$573,850

$734,650

$888,000

$1,103,550

Ada, Boise, Canyon, Gem, Owyhee

$586,500

$750,800

$907,550

$1,127,900

Blaine, Camas

$759,000

$971,650

$1,174,500

$1,459,650

Teton

$1,209,750

$1,548,975

$1,872,225

$2,326,875

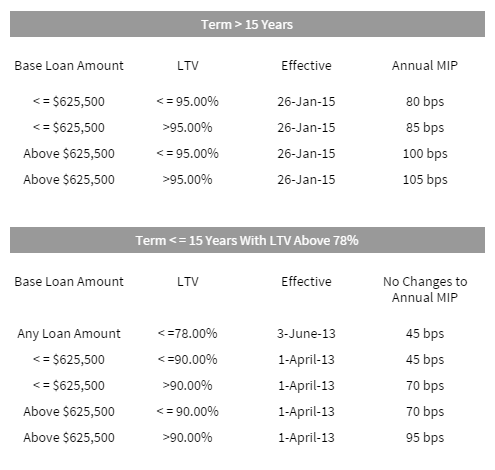

Current Up-Front Mortgage Insurance Premium

The UPMIP is currently at 1.75% of the base loan amount. This applies regardless of the amortization term or LTV ratio.

Current Annual MIP Premium (monthly PMI factor included with payment)

We consistently strive to offer consumers the best possible mortgage experience by using a transparent and systematic approach that makes lenders compete for your business. The more educated the consumer, the greater chance they will become a Vantage client when comparing mortgage providers. Don’t just take our word for it, here are some reviews that our past customers have left!