The Homeowners Protection Act of 1998 (How to Get Rid of Mortgage Insurance)

I’m assuming the most popular question with regard to private mortgage insurance (with conventional financing) is how to cancel it? Fortunately, there are many ways it can be canceled.

In the past, homeowners continued to pay PMI even after their LTV fell below 80% because the banks and mortgage lenders were not required to notify borrowers. It used to be the responsibility of the borrower to cancel PMI once they reached the 80% LTV mark, but recent laws have forced the banks and lenders to take responsibility as well.

Automatic Termination of PMI

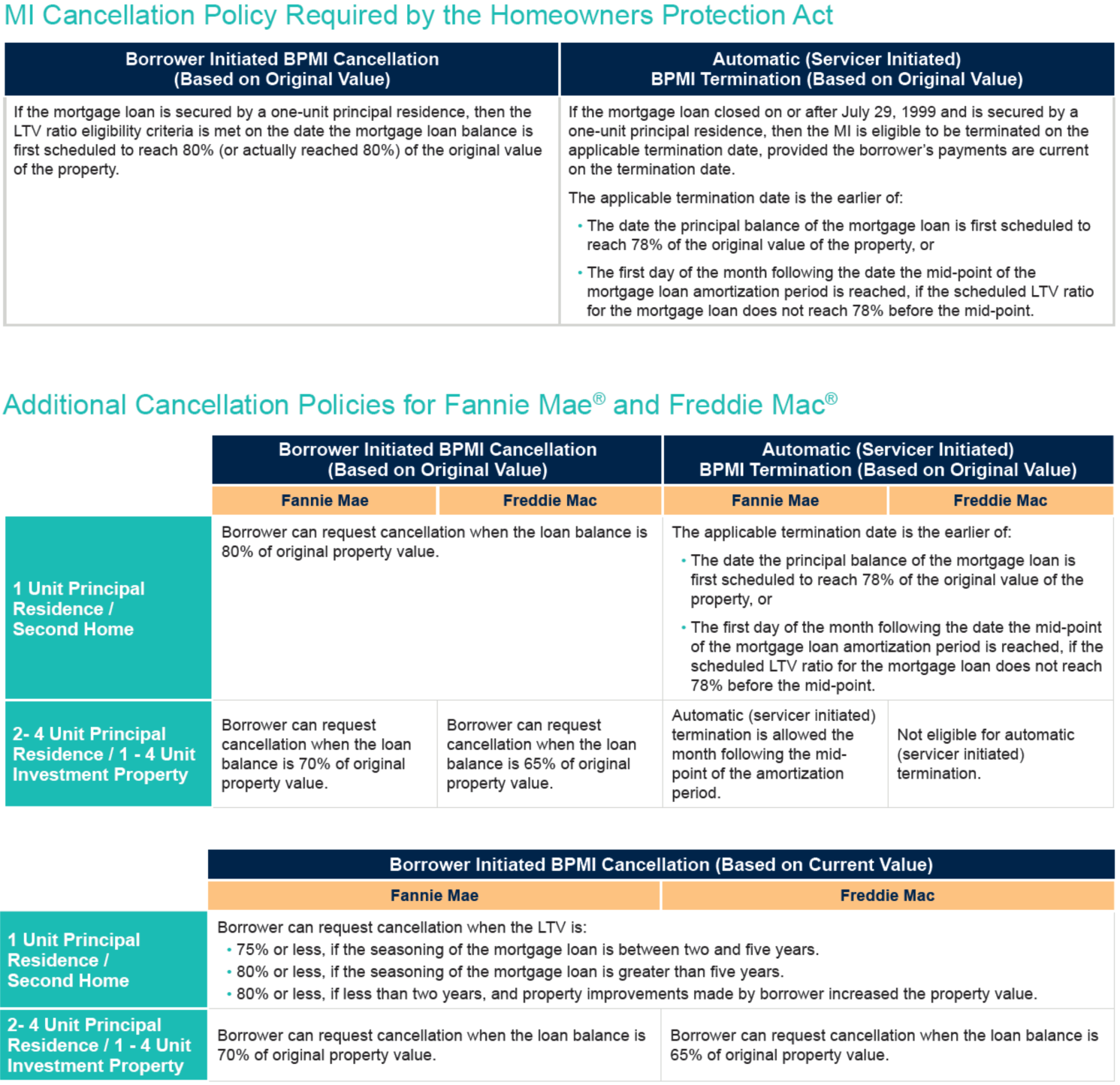

All the confusion led to the Homeowners Protection Act of 1998, which established rules regarding termination of private mortgage insurance on principal residences.

The law requires home mortgages signed on or after July 29, 1999 to automatically terminate PMI once the homeowner reaches 78% LTV, or gains 22% equity in their home, based on the original property value(lesser of purchase price/appraised value).

Just note that you must be current on your mortgage when you hit 78% LTV to get PMI removed. If you aren’t, it will be automatically terminated on the first day of the first month following the date that you become current.

Borrower Requested Termination of PMI

The law also allows homeowners to request the termination of PMI once they gain 20% home equity, or 80% LTV of the original value. So at that time you can contact your lender and ask for the PMI payments to cease. But they won’t contact you, so you’ve got to keep an eye on your loan amortization schedule to figure out when you’ll hit that key level.

If you happen to make extra mortgage payments and/or your property has increased in value (or if you made documented improvements to your property), you might be able to submit a request for cancellation even faster. But you may have to pay for an appraisal, so bear that in mind.

And you must have a good payment history (no 30-day late payments in the past year or 60-day late payments in the past two years), be current on your loan, and submit a written cancellation request.

Final Termination of PMI

The Homeowners Protection Act has one final option to remove PMI. If for some reason PMI was not canceled by request or automatic termination, the loan servicer must cancel mortgage insurance by the first day of the month immediately following the midpoint of the loan’s amortization period.

Again, the borrower must be current on their mortgage on this date for this rule to go into effect.

Mortgage servicing companies must provide a telephone number for all their mortgagors to call for information about termination and cancellation of PMI. And new borrowers covered by the law must be told – at closing and once a year – about private mortgage insurance termination and cancellation.

The Homeowners Protection Act of 1998 does come with some exceptions though. If your loan is considered “high risk”, if your property has additional liens, or if you were not current on your mortgage within the year prior to termination or cancellation, you could be stuck with PMI until those issued are resolved.

Additionally, it does not cover FHA Loans or VA Loans, or loans with Lender-Paid PMI.

Though the law does not cover loans that were signed before July 29, 1999, or loans with lender-paid MI, lenders or mortgage servicers must tell borrowers about the termination or cancellation rights they may otherwise have with such loans (including rights established by the contract or state law).

If you signed loan documents before July 29, 1999 you will have to manually terminate your private mortgage insurance once you reach 20% equity in your home, or 80% LTV or less. Be careful to pay special attention to this as the lender or bank is not required to notify you, and you will continue paying PMI if you fail to act.

There are many other specific statewide rules and rules for Fannie Mae and Freddie Mac loans, so always do your own due diligence, and contact your bank or lender to get all the facts for your specific loan in your particular state.

Tip: If you do happen to have a loan with mortgage insurance, you can always refinance out of it and drop the mortgage insurance if the new loan has an LTV of 80% or less. It’s not advisable to refinance just to get rid of mortgage insurance, but if you can snag a lower rate in the process, it could be a smart move.