How Wholesale Mortgage

Lenders Compete For Our

Business and Their Advantages

competition (n); an activity done by a number of organizations, each which is trying to do better than all of the others (producing a better product and experience at a lower cost)

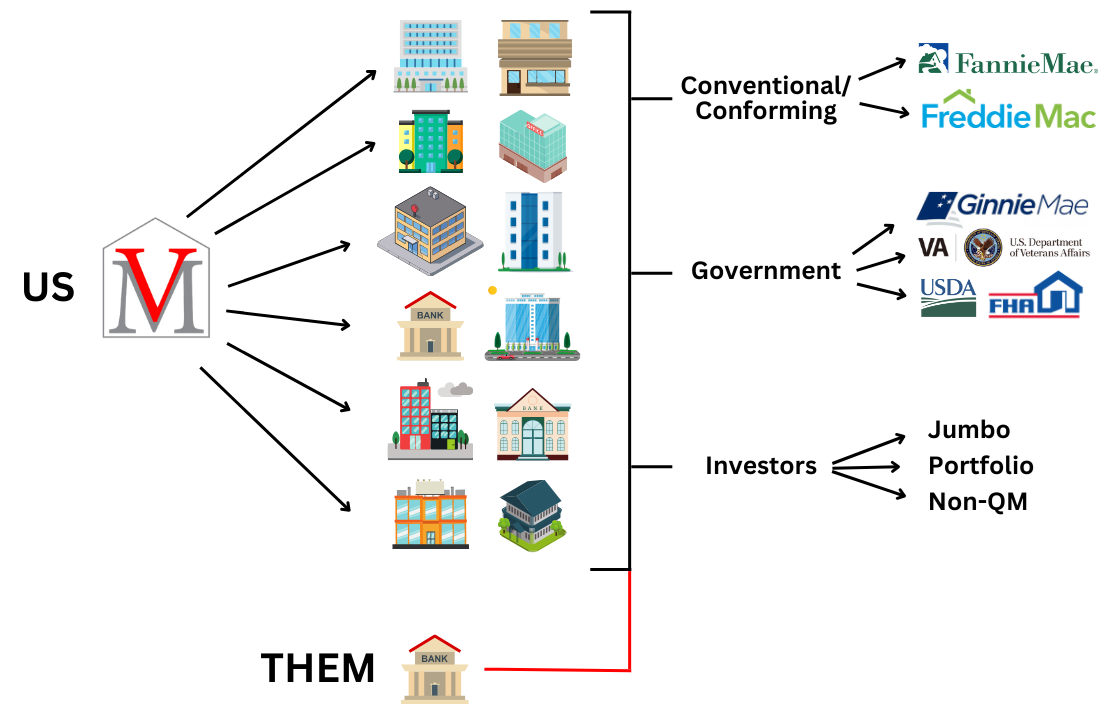

Vantage Mortgage Brokers has been servicing the Pacific Northwest Exclusively since 2007. Our team of independent experts has over 20 years of individual experience. We have used our unique platform and this experience to partner with only the best wholesale lenders in the United States. We hold a high standard in pricing, execution, reputation, and integrity when selecting wholesale lending partners. Our top-tier reputation with the industry and these investors allow our clients to have unique access to programs and pricing.

Overview: How Wholesale Mortgage Lenders Compete for Our Business and Their Advantages

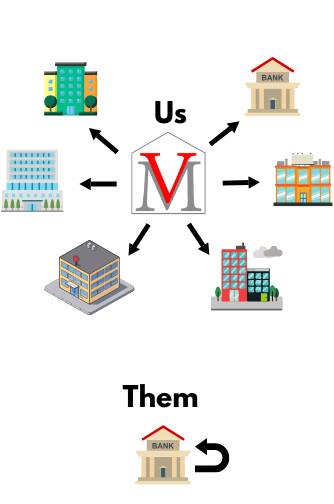

Wholesale mortgage lending operates in a dynamic marketplace where lenders vie to offer competitive terms to brokers and their clients. Unlike retail lenders, wholesale lenders do not interact directly with borrowers. Instead, they partner with mortgage brokers who act as intermediaries, presenting loan options to customers and facilitating the borrowing process. This competitive structure creates several distinct advantages for both borrowers and brokers.

How Our Wholesale Lenders Compete:

- Rate Competition:

Wholesale lenders frequently adjust their rates to stay attractive in the market. By offering lower interest rates or reduced fees, they aim to win the attention of brokers and their clients. - Diverse Loan Products:

To cater to a broad range of borrowers, wholesale lenders compete by offering an extensive variety of loan products. These can include conventional loans, FHA, VA, jumbo loans, or niche products tailored to specific borrower needs. - Faster Turnaround Times:

Speed and efficiency are critical in the lending industry. Wholesale lenders often invest in technology and streamlined processes to provide faster approvals and closings, giving them a competitive edge. - Flexible Underwriting Guidelines:

Many wholesale lenders compete by offering more flexible underwriting criteria, allowing brokers to find solutions for clients who might not qualify under stricter guidelines from traditional retail lenders. - Broker Support and Tools:

Strong relationships with brokers are key. Wholesale lenders compete by providing dedicated broker support, training, marketing tools, and digital platforms that enhance the broker-client experience.

COMPETITION = CONFIDENT

MORE CHOICES = LESS $

LESS CHOICES = MORE $

In the United States, residential mortgage loans are backed by agencies behind the scenes, such as Fannie Mae, Freddie Mac, Ginnie Mae, and private investors.

Independent origination ensures lenders compete for the same loan to secure more competitive terms rather than being steered to one lender or rate sheet.

CAPTIVE = CONFLICT

Advantages of Wholesale Mortgage Lender Competition:

- More Competitive Rates and Terms for Borrowers:

With multiple lenders competing, brokers can shop around for more competitive rates, fees, and loan terms, resulting in significant savings for borrowers. - Tailored Loan Solutions:

Borrowers benefit from customized options that fit their unique financial situations. Whether it’s a specialized loan product or a more flexible qualification process, wholesale lenders offer choices that retail lenders may not. - Transparency in the Process:

Brokers acting as intermediaries ensure borrowers have access to clear comparisons, enabling informed decisions. The competitive nature of wholesale lending fosters an environment of transparency. - Efficiency and Expertise:

Wholesale lenders often have dedicated underwriting and processing teams, which, combined with broker expertise, leads to smoother and faster loan closures. - Empowered Mortgage Brokers:

Competition among wholesale lenders equips brokers with a broad arsenal of tools and options, enabling them to serve clients effectively and strengthen their business offerings.

Conclusion:

The competition among wholesale mortgage lenders fosters a buyer-friendly market where borrowers can secure more favorable loan terms, brokers can expand their offerings, and lenders continuously innovate to stay ahead. By choosing to work with a broker connected to wholesale lenders, borrowers tap into the power of this competitive marketplace, gaining access to tailored solutions, expert support, and significant savings.

We consistently strive to offer consumers the best possible mortgage experience by using a transparent and systematic approach that makes lenders compete for your business. The more educated the consumer, the greater chance they will become a Vantage client when comparing mortgage providers.