Compare and Analyze Mortgage Rates,

Payments, Terms, Costs, Credits, and

Most Favorable Outcome for Your Financial Goals

compare (v); to examine (two or more objects, rates, financial options, etc.) in order to note similarities and differences in benefits and goals (recapture analysis)

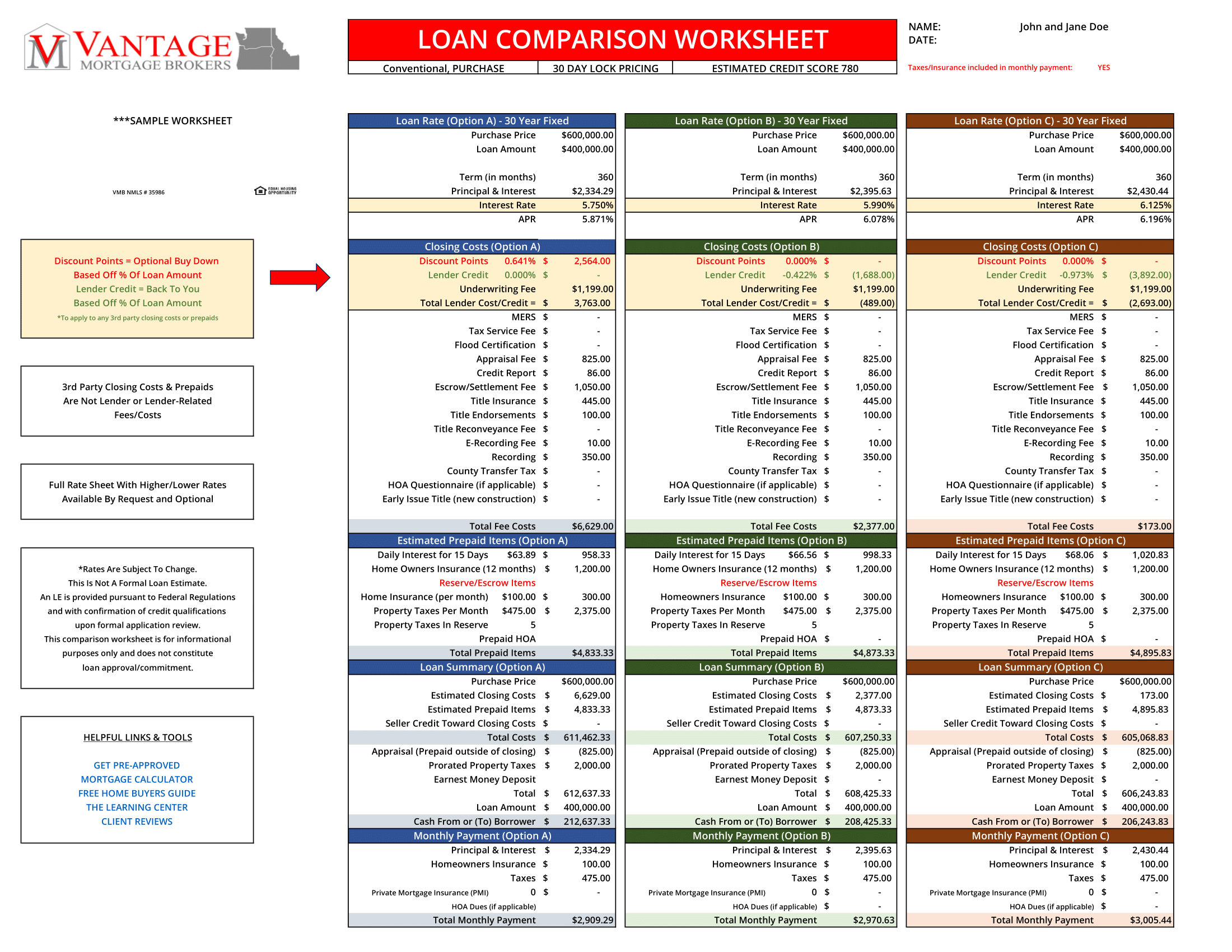

At Vantage Mortgage Brokers, we understand that navigating the complexities of mortgage financing can be daunting. That’s why we are dedicated to equipping our clients with clear, data-driven insights to make informed decisions. Through the use of loan comparison worksheets, optional rate sheets, and recapture math, we demystify the mortgage process and help our clients weigh the benefits of discount points, lender credits, and rate options.

Comprehensive Loan Comparison Process

- Loan Comparison Worksheets:

Our loan comparison worksheets serve as a side-by-side evaluation tool, allowing clients to see how various loan offers stack up. Each worksheet highlights key metrics such as:

-

- Interest rates

- Monthly payments

- Total costs over the life of the loan

- Closing costs

- Any lender credits or discount points applied

By presenting this information in an easy-to-read format, we empower our clients to identify the loan that best fits their financial goals.

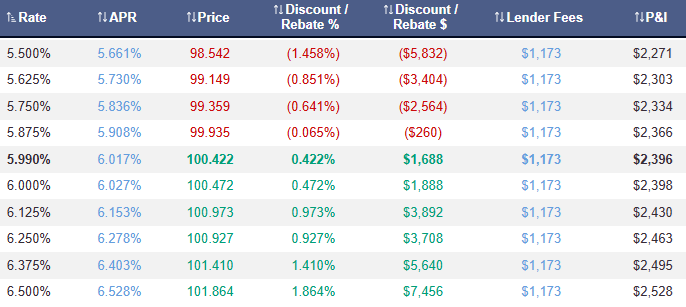

- Optional Rate Sheets for Customization:

We go a step further by providing optional rate sheets that outline multiple pricing scenarios. These sheets include a range of interest rate options along with their corresponding costs or credits.

-

- Discount Points: Clients can see how prepaying interest through discount points impacts their monthly payment and long-term savings.

- Lender Credits: We show how lender credits can reduce upfront costs while adjusting the overall loan expense.

This flexibility allows clients to tailor their loan structure to their unique priorities, whether they prefer lower upfront costs or long-term savings.

- Recapture Math for Financial Clarity:

To help clients fully understand the trade-offs, we calculate the “recapture period” for loans involving discount points or lender credits. This math determines:

-

- Break-Even Point: How long it will take for the savings from a lower interest rate to offset the upfront cost of discount points.

- Long-Term Impact: Whether paying points or accepting lender credits aligns with the client’s timeline for staying in the home or refinancing in the future.

By providing this data, we ensure clients can see the real financial impact of their decisions.

How Vantage Adds Value to the Process

- Expert Analysis:

Our team leverages years of experience to interpret and present complex data in a way that’s understandable and actionable for clients. - Transparency and Objectivity:

We act as fiduciaries in the mortgage process, putting our clients’ interests first. By offering clear comparisons and unbiased advice, we empower clients to make confident choices. - Customized Solutions:

No two clients are the same, and neither are their mortgage needs. Our approach ensures every loan comparison is tailored to the individual, helping them align financing decisions with their goals. - Maximizing Savings:

Whether through evaluating rate buy-down options, reducing upfront costs with lender credits, or identifying the most cost-effective loan product, we help clients maximize their financial advantages.

Conclusion:

At Vantage Mortgage Brokers, our mission is to make the mortgage process clear, simple, and tailored to your needs. By utilizing loan comparison worksheets, optional rate sheets, and recapture math, we provide the tools and expertise to help you make the most informed and financially sound decision possible. With Vantage by your side, you can confidently choose a mortgage that supports your long-term goals.

We consistently strive to offer consumers the best possible mortgage experience by using a transparent and systematic approach that makes lenders compete for your business. The more educated the consumer, the greater chance they will become a Vantage client when comparing mortgage providers.