This continues to be a volatile and challenging year for mortgage rates and housing inventory. With…

Vantage Mortgage Summer Newsletter 2019

New Data Shared Each Month

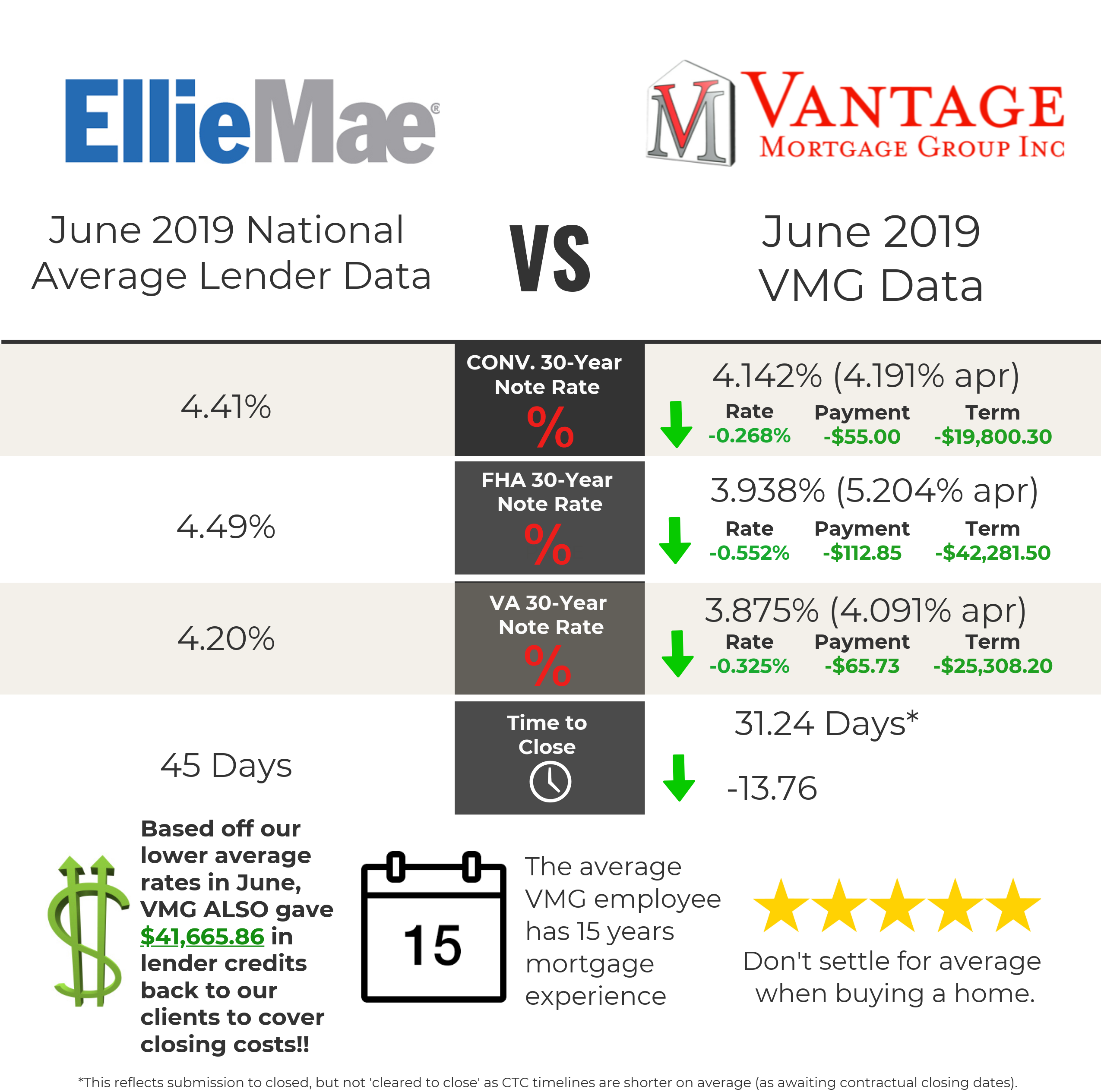

We continue to make waves in the Pacific NW and challenge big retail lenders to expose special interests and conflicts in the primary mortgage space. While we provide an independent and transparent platform which requires the top wholesale lenders to compete for our clients (working for you rather than the lenders), we also strive to have the most experienced team behind everything we do.

Now we’re collecting and sharing data to show what VMG can do as a result of our position and vision using info graphics. In addition to offering lower rates and costs with a smoother process, we’re also proud to have provided over $40,000 in lender credits just in June and over $157,000 in lender credits YTD (through July 18) our clients in Oregon & Washington can apply to 3rd party closing costs and prepaids.

Thank you everyone for sharing VMG with your friends and family members (or clients for business partners). We greatly appreciate your support of our local small business. We have also added some awesome team members over the last couple of years and very proud of our culture and the great people we now call family.

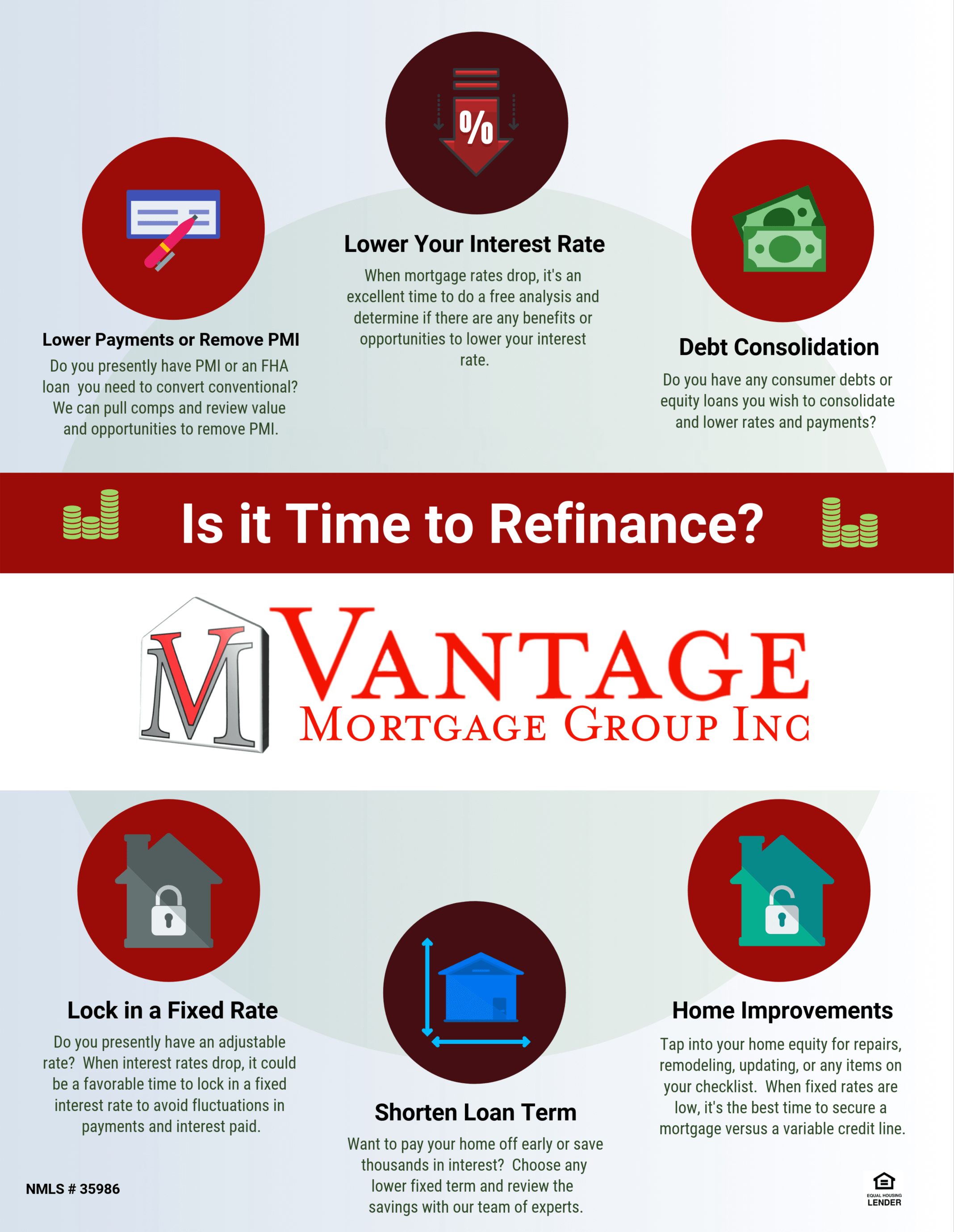

In addition to our rate update below, now may be a good time to consider refinancing while rates are at a 2-3 year low for those that may be in the following scenarios.

Contact us for a custom rate quote anytime (always free and never obligated) or you can play with our pricing engine to run some general numbers.

**As a reminder, don’t fall for any mail solicitations/calls you receive from lenders, including your current loan servicer. Going back to the lender that services your loan results in higher rates and fees (and does not streamline as they do not own your loan and only service it). When competition doesn’t apply, costs are always higher with ‘one’ lender. This is why our wholesale lending partners are prohibited from soliciting our clients even if they service your loan so please report it to us if that happens and happy to compare quotes and details either way.

Do You Know a Veteran?

We don’t need a holiday to celebrate Veterans, at VMG we celebrate them everyday! We continue to fight against big retail targeting their benefits when buying a home.

At Vantage, we strongly support the brave men and women of our military. We understand a VA loan is more than just another mortgage. It is a BENEFIT to those who serve our country.

Over the years we have seen a growing issue that must be addressed. Many retail mortgage lenders and the employees that work for them have been steering Veterans to one rate sheet. Without competition, lenders have targeted the VA benefit by charging significantly higher rates and hiding credits that would otherwise be passed onto the Veteran.

Ever Wonder What Drives Mortgage Rates?

READ MORE HERE ABOUT OUR PLEDGE TO VETS.

As you can imagine, we constantly get the question of ‘where are rates going’ or ‘should I lock’? Even the top experts following mortgage-backed securities and the bond market are wrong about 50% of the time. Many things are hard to predict other than speculation on upcoming economic events or data that are known.

Unlike most other interest rates, those for mortgages (except ones for existing adjustable-rate mortgages) are largely determined by the supply of money into the market from investors and the demand for such loans from consumers. That supply is heavily affected by the amount of risk investors are prepared to sustain in their portfolios. When spooked by economic uncertainty, they tend to buy safer assets, including mortgage securities, which can result in an increased supply of product (cash) that drives down the price (rates). When they’re more confident, they tend to invest in riskier but more profitable assets, which reduces the supply of money for home loans, and pushes up rates. A second influence is perceptions of how inflation rates are likely to move over the long term, but that usually tends to be a less important factor in daily and short-term movements. None of this is to suggest the Federal Reserve doesn’t affect mortgage rates, merely that it does so only indirectly by influencing investor sentiment.

The relationship between 10-year Treasury bonds and mortgage rates is more complicated. Investors generally view those bonds and mortgage securities as similarly secure havens for their money when they’re spooked – with bonds the safer of the two. That means they tend to buy or sell both at the same time, depending on their level of confidence in the U.S. and global economies. So many lenders refer to those particular Treasury yields when setting their rates. Usually, the relationship between 10-year Treasury yields and mortgage rates is surprisingly close, though rates tend to be less volatile, and sometimes the two drift apart a little.

Read more about mortgage rates HERE.

Oregon & Washington Real Estate Update

OREGON:

The median home value in Oregon is $345,800. Oregon home values have gone up 3.9% over the past year and Zillow predicts they will rise 1.6% within the next year. The median list price per square foot in Oregon is $221. The median price of homes currently listed in Oregon is $389,997 while the median price of homes that sold is $338,200. The median rent price in Oregon is $1,795.

Foreclosures will be a factor impacting home values in the next several years. In Oregon 1.1 homes are foreclosed (per 10,000). This is lower than the national value of 1.2

Mortgage delinquency is the first step in the foreclosure process. This is when a homeowner fails to make a mortgage payment. The percent of delinquent mortgages in Oregon is 0.6%, which is lower than the national value of 1.1%. With U.S. home values having fallen by more than 20% nationally from their peak in 2007 until their trough in late 2011, many homeowners are now underwater on their mortgages, meaning they owe more than their home is worth. The percent of Oregon homeowners underwater on their mortgage is 4.1%.

WASHINGTON:

The median home value in Washington is $387,100. Washington home values have gone up 5.2% over the past year and Zillow predicts they will rise 2.4% within the next year. The median list price per square foot in Washington is $242. The median price of homes currently listed in Washington is $425,000 while the median price of homes that sold is $370,300. The median rent price in Washington is $2,100.

Foreclosures will be a factor impacting home values in the next several years. In Washington 0.8 homes are foreclosed (per 10,000). This is lower than the national value of 1.2

Mortgage delinquency is the first step in the foreclosure process. This is when a homeowner fails to make a mortgage payment. The percent of delinquent mortgages in Washington is 0.6%, which is lower than the national value of 1.1%. With U.S. home values having fallen by more than 20% nationally from their peak in 2007 until their trough in late 2011, many homeowners are now underwater on their mortgages, meaning they owe more than their home is worth. The percent of Washington homeowners underwater on their mortgage is 4.3%.

Mortgage Rate News & VMG Mortgage Rate Tracker

Mortgage rates are doing favorably. While we have not seen rates as low as the lowest point in 2012, followed by another low point in 2016, we are seeing the lowest rates in the last few years today.

If you would like to be added to our VMG Weekly Rate Tracker, email us to request at info@vantagemortgagegroup.com

If you know of anyone buying a home now or in the near future, please share VMG with them.

To keep an eye on our market-leading mortgage rates or pass on to a friend or family member in the market to buy or refinance, visit our blog: https://vantagemortgagegroup.com/blog/

Come Visit Us!

16325 Boones Ferry Rd. Suite 100 Lake Oswego, OR 97035

As you may know, my business is based on referrals from people like you and those who hear about the quality and detail of our services. Please pass on my information to anyone you know that could benefit from our services.

If you have any questions, please feel free to contact us anytime.

Thank you for your ongoing support and referrals!